Tag Archive: bill dudley

What Does Taper Look Like From The Inside? Not At All What You’d Think

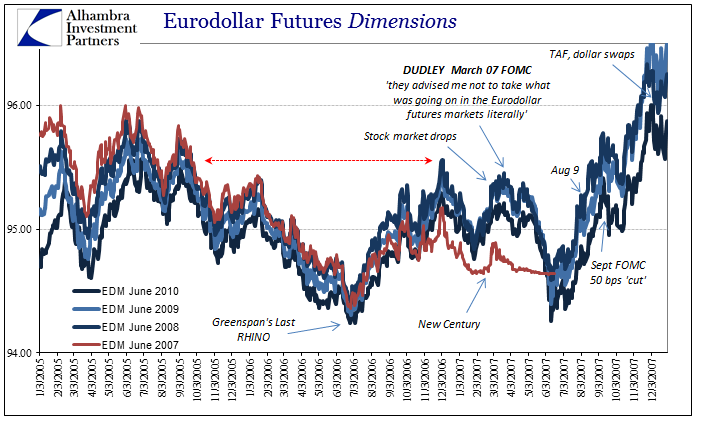

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace.

Read More »

Read More »

CPI’s At Fives Yet Treasury Auctions

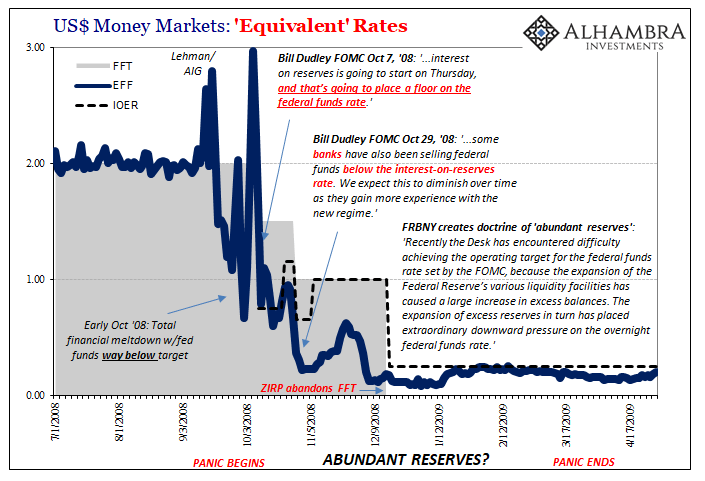

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to.

Read More »

Read More »

The Transitory Story, I Repeat, The Transitory Story

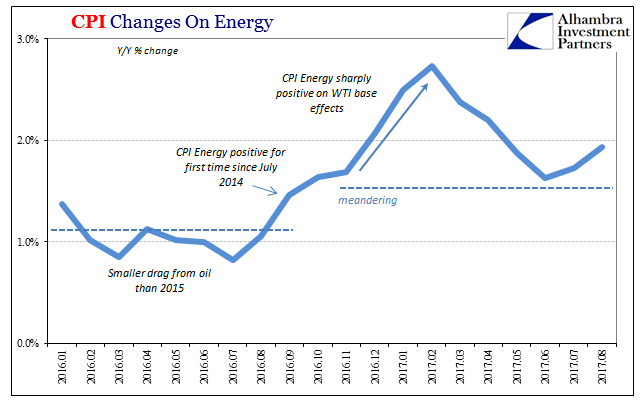

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand.

Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to discuss their lying eyes....

Read More »

Read More »

Chart of the Week: The Dreaded Full Frown

I’m going to break my personal convention and use the bulk of the colors in the eurodollar futures spectrum, not just the single EDM’s (June) contained within each. The current front month is January 2019, and its quoted price as I write this is 97.2475. The EDH (March) 2019 contract trades at 97.29 currently and it will drop off the board on March 18.

Read More »

Read More »

Unexpected?

Now that the slowdown is being absorbed and even talked about openly, it will require a period of heavy CYA. This part is, or at least it has been at each of the past downturns, quite easy for its practitioners. It was all so “unexpected”, you see. Nobody could have seen it coming, therefore it just showed up out of nowhere unpredictably spoiling the heretofore unbreakable, incorruptible boom everyone was talking about just last week.

Read More »

Read More »

The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal reasons.”

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

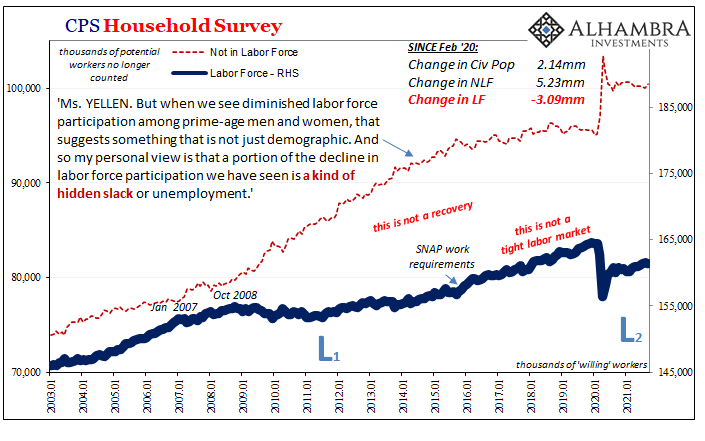

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »