Tag Archive: Ben Bernanke

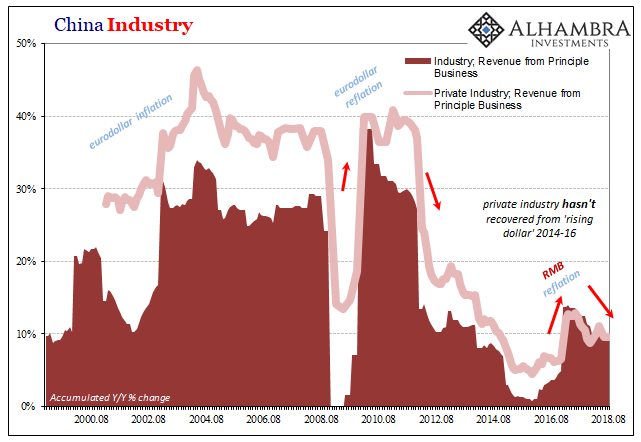

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

Political Economics

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t the usual R vs. D, left vs....

Read More »

Read More »

US Export/Import: ‘Something’ Is Still Out There

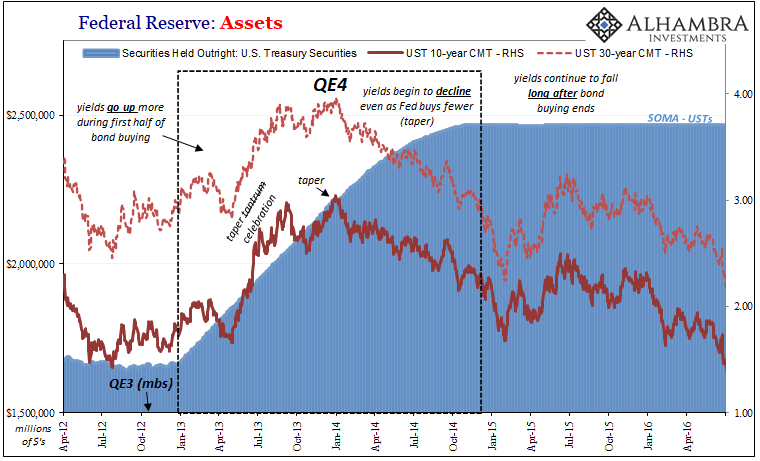

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013.

Read More »

Read More »

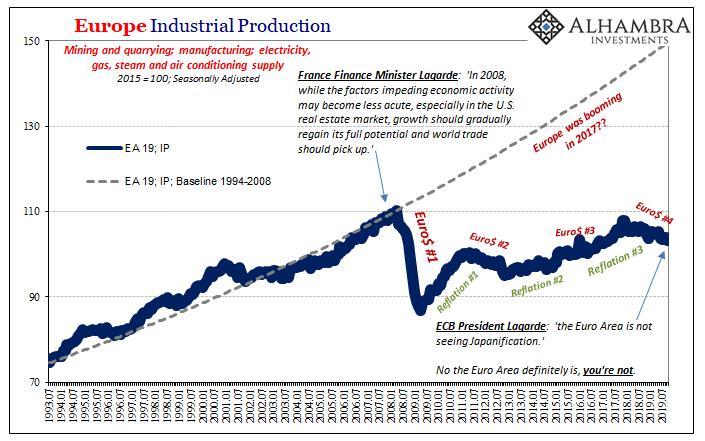

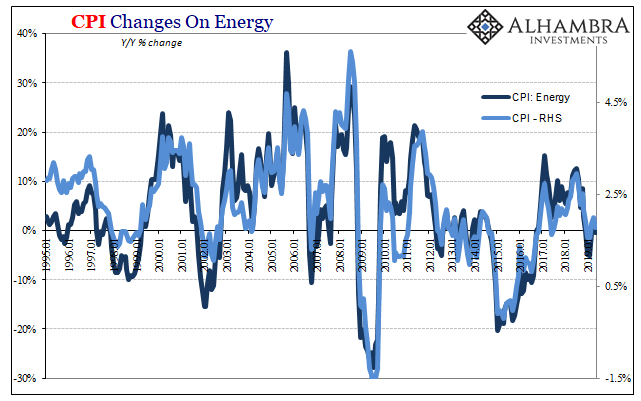

Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions.

Read More »

Read More »

Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook.

Read More »

Read More »

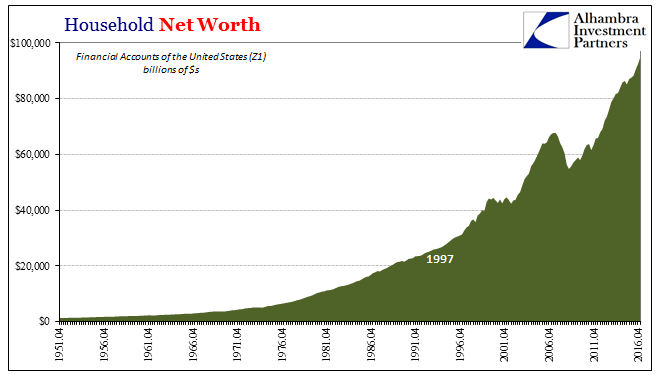

Wealth Paradox Not Effect

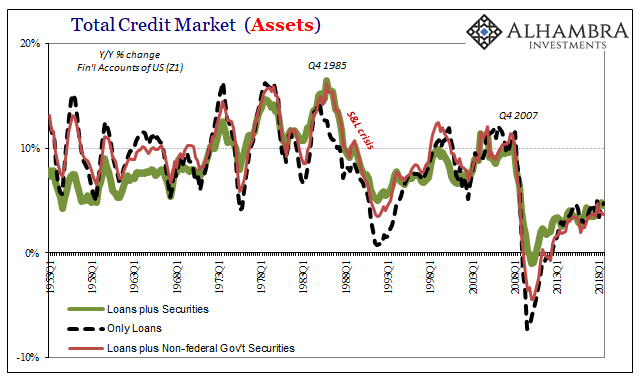

US Household Net Worth rose to a record $94.8 trillion in Q1 2017. According to the Federal Reserve’s Financial Accounts of the United States (Z1), aggregate paper wealth rose by more than 8% year-over-year mostly as the stock market shook off the effects of “global turmoil.” It was the best rate of expansion since the second quarter of 2014 just prior to this “rising dollar” interruption.

Read More »

Read More »

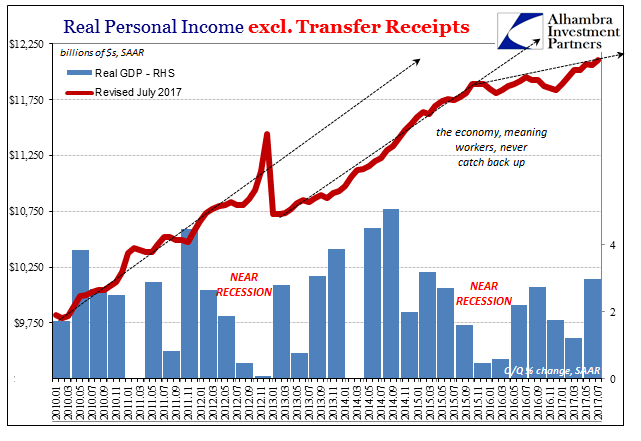

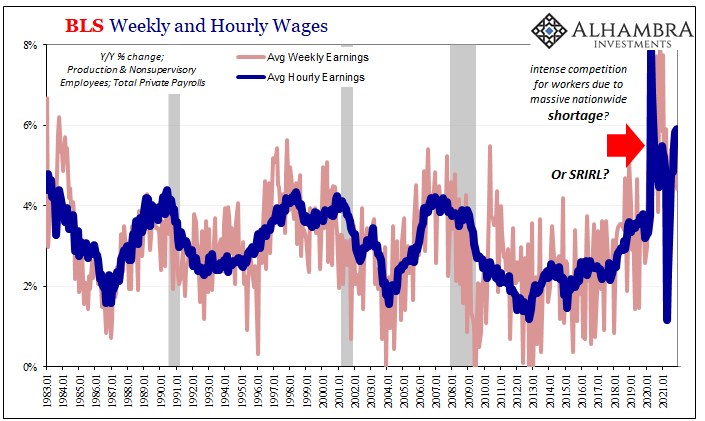

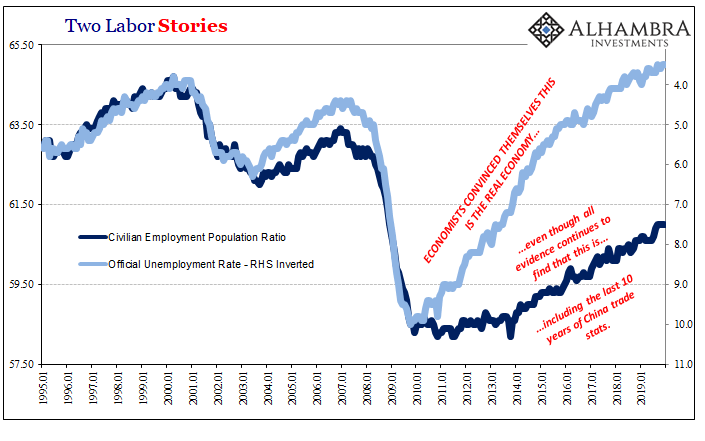

Signs of Something, Just Not Wage Acceleration

I have been writing for many years that they really don’t know what they are doing. I only wish it was that simple. There has been developing another layer or dimension to that condition, a second derivative of stupid, whereby when faced with this now well-established fact the same people, experts and authorities all, they have no frame of reference to figure out what next to do. In other words, they really don’t know what to do when they realize...

Read More »

Read More »

Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it.

Read More »

Read More »

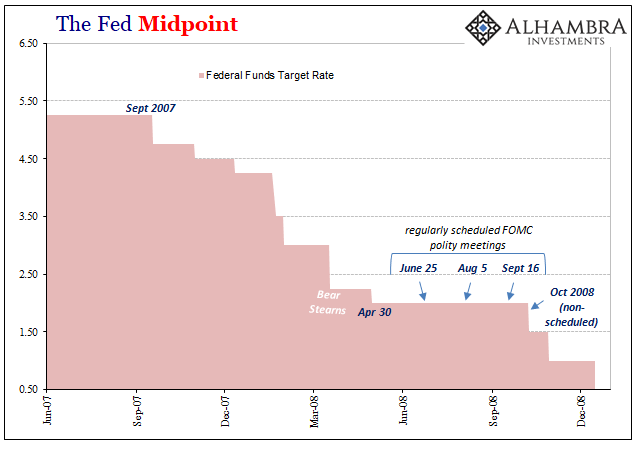

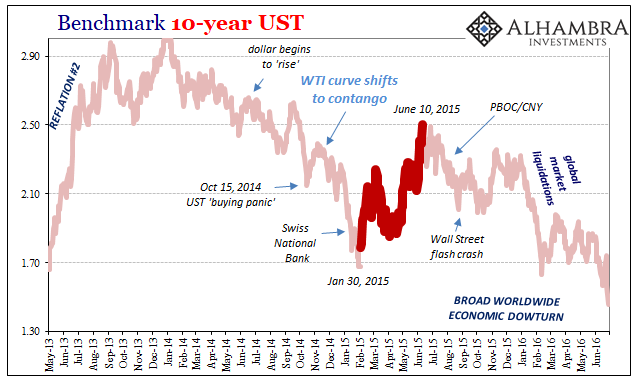

All In The Curves

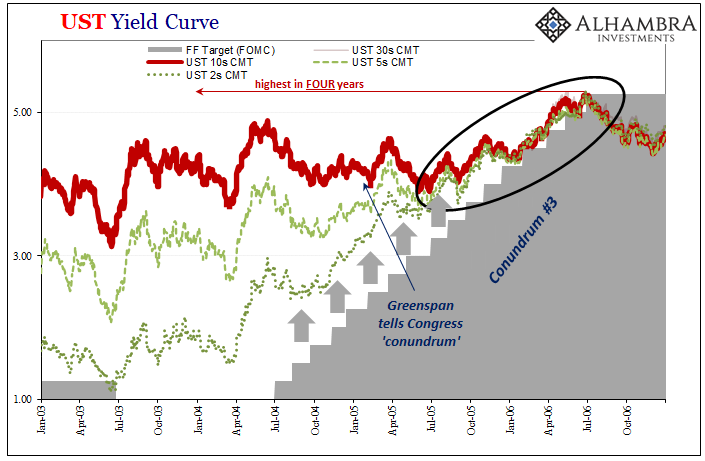

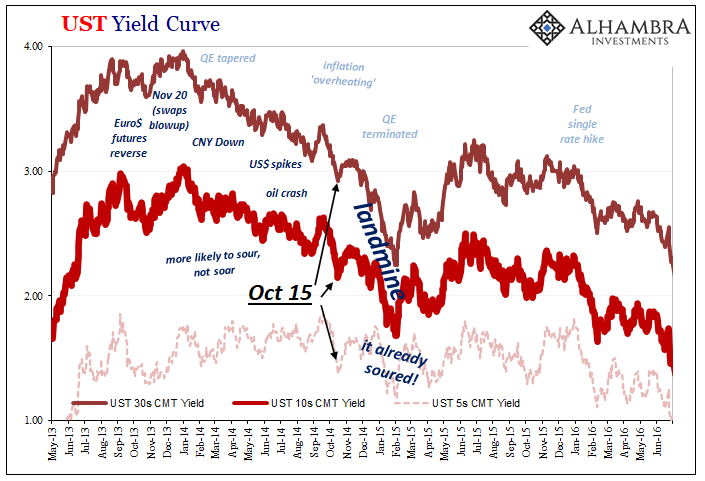

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

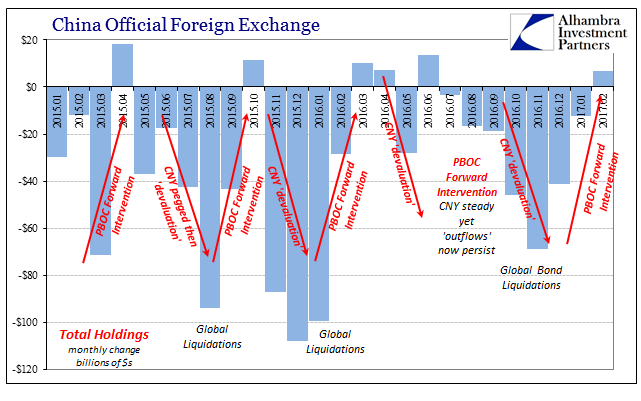

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

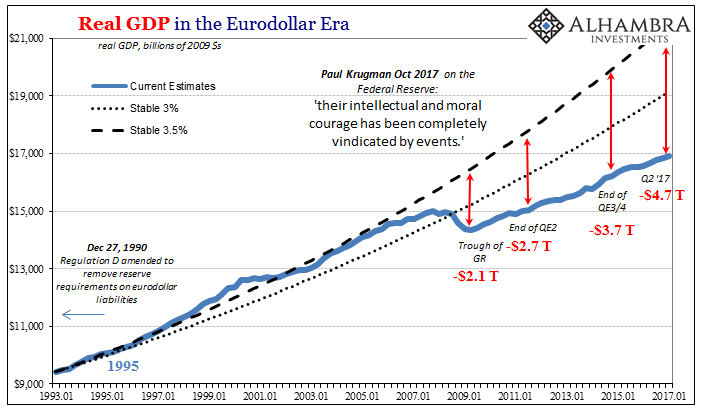

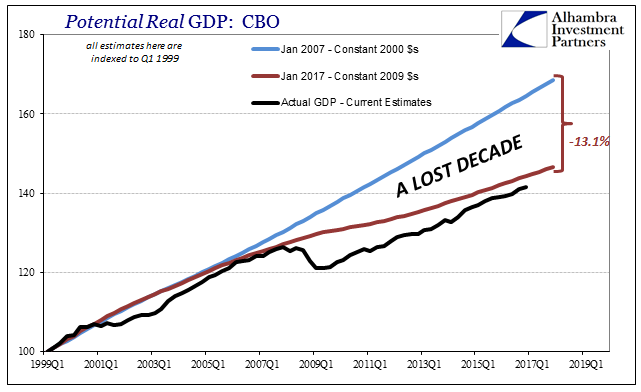

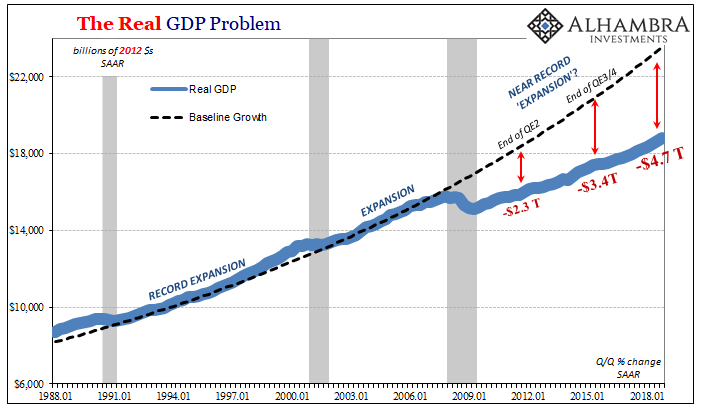

The Stinking Politics of It All

It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one...

Read More »

Read More »

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

Bernanke Suggests How to Use the Dot Plots

The dot plots are not FOMC commitments or an aggregate view of the FOMC. They are a collection of individual economic forecasts based on the most likely scenario and their view of appropriate policy. The SEP is useful for understanding how Fed officials view the long-term economic parameters, which appears to explain the downward shift in the long-term equilibrium rate for Fed funds.

Read More »

Read More »

Is there a Savings Glut?

In his speech at the New York Federal Reserve of New York on October 5, 2016, the Federal Reserve Vice Chairman Stanley Fischer has suggested that a visible decline in the natural interest rate in the US could be on account of the world glut of saving. According to Fischer, both increased saving and reduced investments have potentially significantly lowered the natural rate of interest.

Read More »

Read More »

Donald, the “Maestro” and the Politically Controlled Fed

The Crazies, Former Federal Reserve Chairman Alan Greenspan, who was once laudably referred to as “Maestro” for his supposed astute stewardship of U.S. monetary policy, commented last week on the nation’s current political and economic climate.

Read More »

Read More »

Loose Monetary Policy and Social Inequality

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative...

Read More »

Read More »

Bernanke’s Advice: More Emphasis on Data, Less on Fed Guidance

Bernanke reviews the changes in the long-term dot plots. There as been a clear trend toward lower long-term growth, unemployment and Fed funds equilibrium. The full adjustment may not be over.

Read More »

Read More »

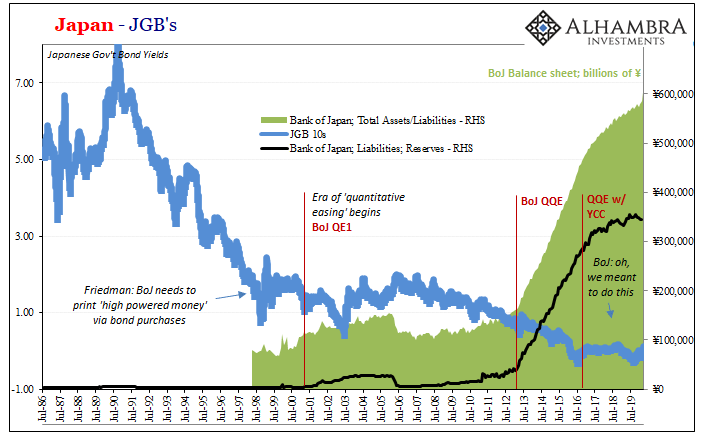

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »