Tag Archive: Ben Bernanke

Another One Inverts, The Retching Cat Reaches Treasuries

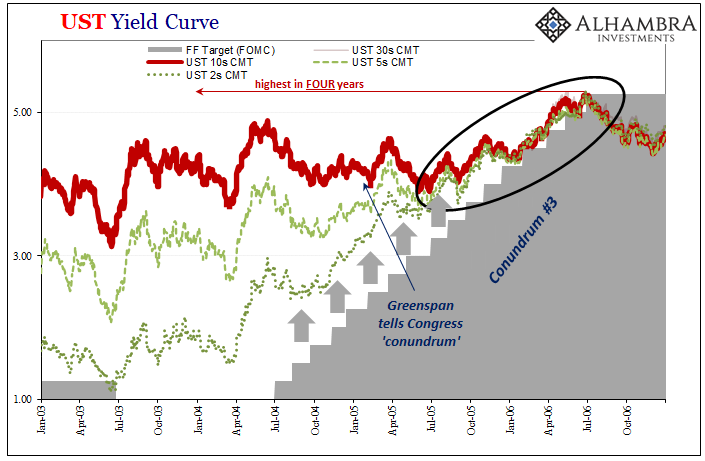

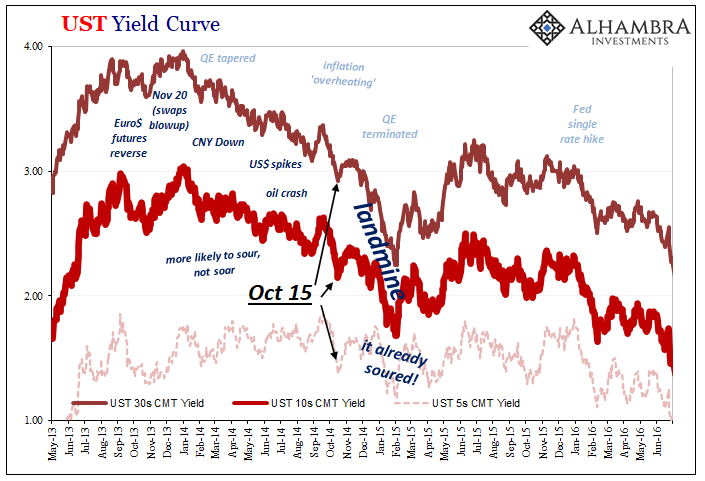

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite.

Read More »

Read More »

The Hawks Circle Here, The Doves Win There

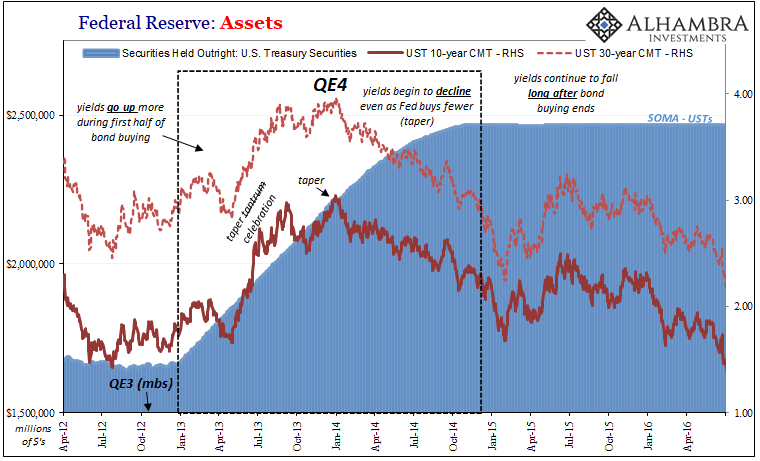

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A...

Read More »

Read More »

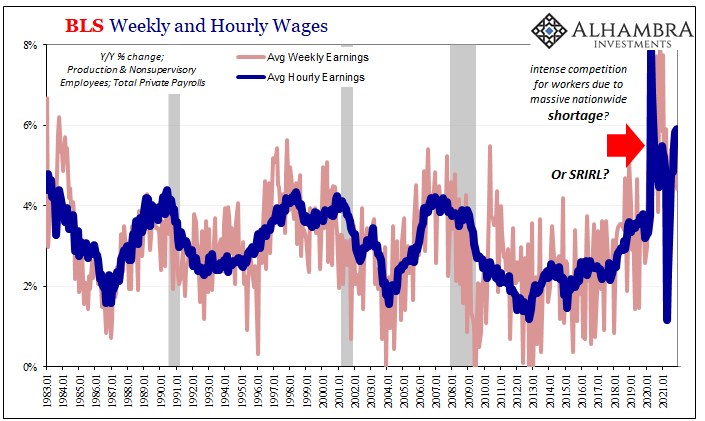

As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation.

Read More »

Read More »

The Curve Is Missing Something Big

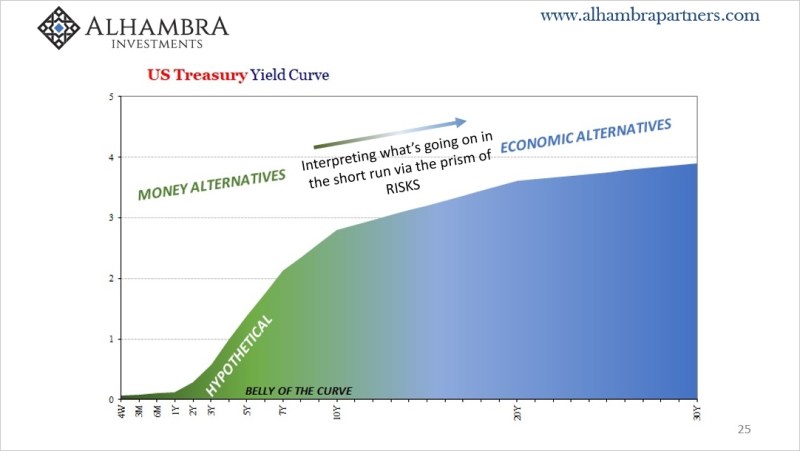

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below).

Read More »

Read More »

The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.”

Read More »

Read More »

Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary.

Read More »

Read More »

CPI’s At Fives Yet Treasury Auctions

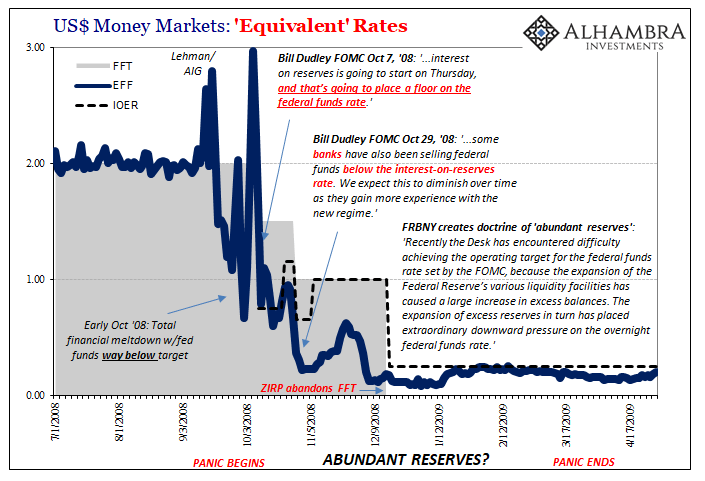

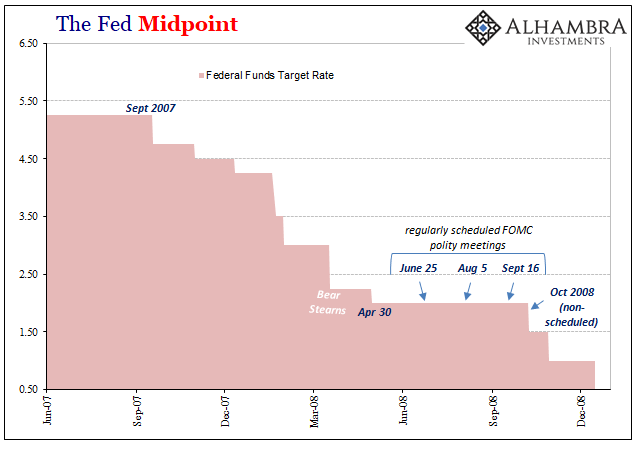

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to.

Read More »

Read More »

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

It’s Not About Jobless Claims Today, It’s About What Will Hamper Job Growth In A Few Months

You’ve no doubt heard about the jobless claims number. At an incomprehensible 3.28 million Americans filing for unemployment for the first time, this level far exceeded the wildest expectations as the economic costs of the shutdown continue to come in far more like the worst case. And as bad as 3mm is, the real hidden number is likely much higher.

Read More »

Read More »

History Shows You Should Infer Nothing From Powell’s Pause

Jay Powell says that three’s not a crowd, at least not for his rate cuts, but four would be. As usual, central bankers like him always hedge and say that “should conditions warrant” the FOMC will be more than happy to indulge (the NYSE). But what he means in his heart of hearts is that there probably won’t be any need.

Read More »

Read More »

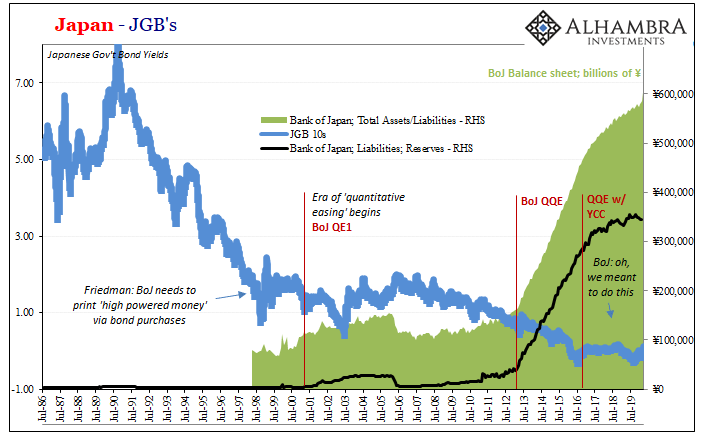

Lagarde Channels Past Self As To Japan Going Global

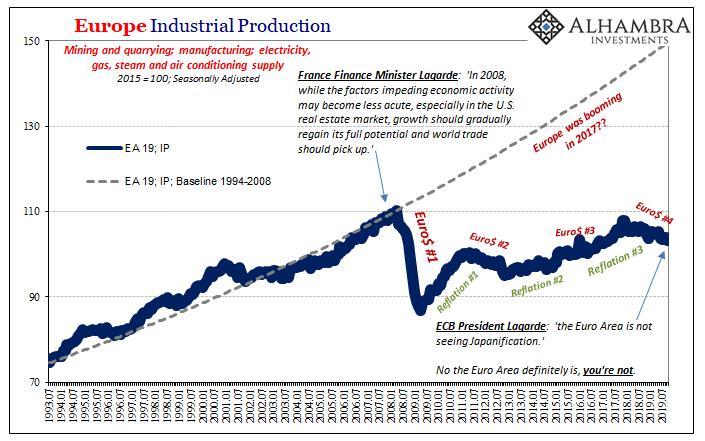

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

Your Unofficial Europe QE Preview

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking.

Read More »

Read More »

Big Difference Which Kind of Hedge It Truly Is

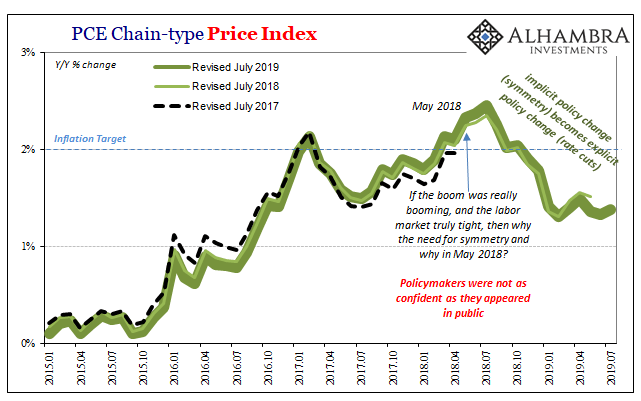

It isn’t inflation which is driving gold higher, at least not the current levels of inflation. According to the latest update from the Bureau of Economic Analysis, the Federal Reserve’s preferred inflation calculation, the PCE Deflator, continues to significantly undershoot. Monetary policy explicitly calls for that rate to be consistent around 2%, an outcome policymakers keep saying they expect but one that never happens.

Read More »

Read More »

When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

Read More »

Read More »

The Transitory Story, I Repeat, The Transitory Story

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand.

Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to discuss their lying eyes....

Read More »

Read More »

Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

Read More »

Read More »

You Know It’s Coming

After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways.

Read More »

Read More »

US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in the real economy, one lost...

Read More »

Read More »

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Read More »

Read More »

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

2022-10-16

by Stephen Flood

2022-10-16

Read More »