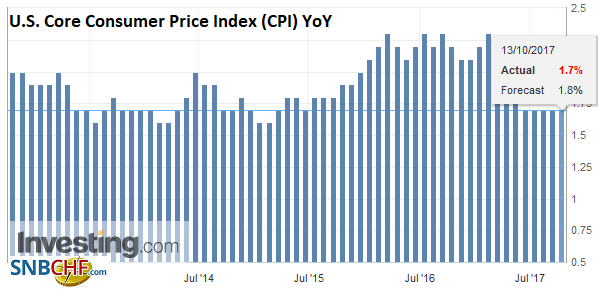

| The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower.

Retail sales were largely in line with expectations. The 1.6% headline increased missed expectations by 0.1%, which is exactly what the August series was revised by (new reading of -0.1% instead of -0.2%). The September increase was the largest in two years. Autos and gasoline accounted for the bulk of the monthly increase, without which retail sales would have grown 0.5%. The components that feed into GDP calculations rose 0.4%, spot on expectations and matches the gain in August. The core CPI disappointed, but it is not that it fell. It was stuck at 1.7% again. It has been steady there since May. The Fed has argued that transitory factors probably account for the decline in inflation this year. Remember that is what policymakers focus on–not why inflation is on a broad decline since the late 1970s or early 1980s. |

U.S. Core Consumer Price Index (CPI) YoY, Sep 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Today’s report gives a tentative support for the Fed’s hypothesis. Wireless phone service, which Yellen specifically cited as a transitory headwind, rose 0.4%. It is the first increase in 14 months. Shelter costs (~1/3 of headline CPI) also have stabilized. They rose 0.3% after a 0.5% increase in August. However, the decline in medical costs (-0.1%) seems to suggest some transitory factors may still be in play, even if diminished. Separately, note that that new and used car prices fell in September.

Taken together, the retail sales and CPI reports were largely in line with expectations. There are differences in methodology between today’s reports and the Fed’s preferred measures. Retail sales are a proxy for consumption, but it only accounts for about 40% of the broader measure of personal consumption expenditure. The Fed does not target core CPI but targets the core PCE deflator. The US dollar quickly dropped on the news. The US 10-year yield slumped below 2.30%. At 2.27%, the low print so far, the yield is back to late-Sept levels. If the Fed does hike rates in December, the new range is 1.25% to 1.50%. The Fed pays interest pegged at the upper end of the Fed funds target range on all reserves. The two-year note yield has slipped to back below 1.50%, unwinding the gains since over the past week. The implied yield on the December Fed funds futures has eased a single basis point to 1.255%. Recall that the current effect Fed funds average (which is the level the contract settles) is 1.16%, and we calculate fair value if the Fed hikes in December of 1.29%. |

US Dollar Currency Index, 13 October 2017(see more posts on U.S. Dollar Index, ) Source: markets.ft.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$TLT,inflation,newslettersent,U.S. Core Consumer Price Index,U.S. Dollar Index