Category Archive: 5.) Charles Hugh Smith

A Lesson in Markets and Bureaucracies: The Very Instructive History of Rat Farms

In effect, authorities created two rat farms, both unintended: the sewers, and the private-sector rat-farms.The history of Rat Farms offers a valuable lesson in how markets and bureaucracies work. The story of how the colonial authorities in Hanoi came to establish two kinds of rat farms is highly instructive. The first rat farm was unintentional.

Read More »

Read More »

What Everybody Knows No Longer Matters

What nobody yet knows (or the few insiders who do know are keeping to themselves) is what will matter. Being a doom-and-gloom Bear stops being fun when the Bear Bar gets crowded.

Read More »

Read More »

What If Everyone’s Wrong (Just Long Enough to Blow Up Their Account)?

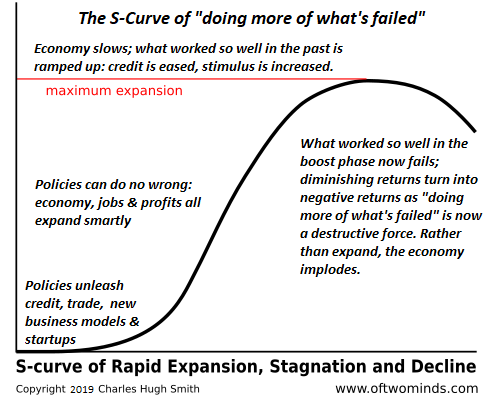

Trying to restore a system that is spiraling away from equilibrium with new extremes of obsolete, misguided policies only accelerates the swings from apparent stability to cascading chaos. The conventional view of the market is there are two sides to every trade and one is right and the other is wrong.

Read More »

Read More »

Everything’s Fixed–Except What’s Broken

Everything's fixed except what's no longer profitable to plunder. Underfunded, ignored, mismanaged by incompetents, it breaks. Everything's fixed--except what's broken. Hmm. Maybe we need to read that again.

Read More »

Read More »

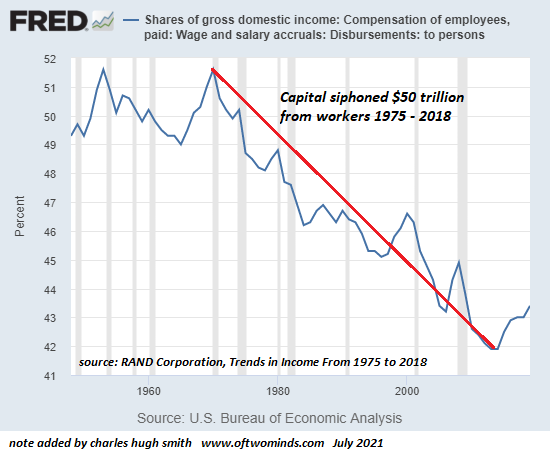

‘Quiet Quitting’ Isn’t Just About Jobs; It’s About a Crumbling Economy

The unraveling of hyper-Globalization and hyper-Financialization will generate consequences few conventional analysts and pundits anticipate.

Read More »

Read More »

Devil’s Advocates are Investors’ Best Friends

If those on the opposite side of the trade are viewed as threats rather than friends, it's time to revise the analysis. Of the many self-generated dangers investors face, few are more dangerous than confirmation bias, the comfort we experience seeking out views that confirm our own positions and our resistance to studying opposing views.

Read More »

Read More »

Charles Hugh Smith on Self Reliance in the 21st Century

Support us on Patreon - https://www.patreon.com/roundtableinsight

http://financialrepressionauthority.com/2022/09/30/the-roundtable-insight-charles-hugh-smith-on-self-reliance-in-the-21st-century/

Read More »

Read More »

Loonshots and Collapse

The momentum of franchise success and centralization of power are fatal. Loonshots are like moonshots, only crazier and trickier to commercialize. Author Safi Bahcall titled his book on how to nurture change-the-world innovations Loonshots: How to Nurture the Crazy Ideas That Win Wars, Cure Diseases, and Transform Industries.

Read More »

Read More »

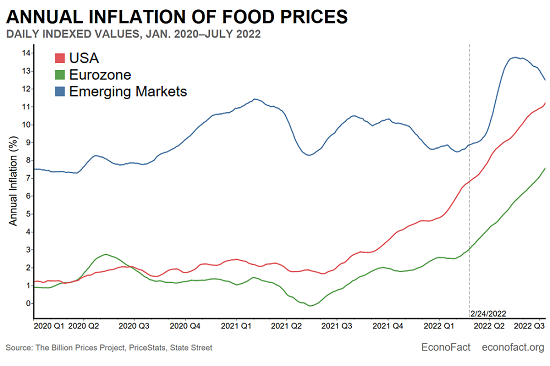

The End of Cheap Food

Global food production rests on soil and rain. Robots don't change that. Of all the modern-day miracles, the least appreciated is the incredible abundance of low cost food in the U.S. and other developed countries.The era of cheap food is ending, for a variety of mutually reinforcing reasons.

Read More »

Read More »

The Fourth Turn, Turn, Turn

The cycles of The Fourth Turning, Fischer and Turchin are all in alignment at this point in history.. The 1997 book The Fourth Turning: An American Prophecy proposed a cyclical pattern of four 20-year generations which culminate in a national crisis every 80 years.

Read More »

Read More »

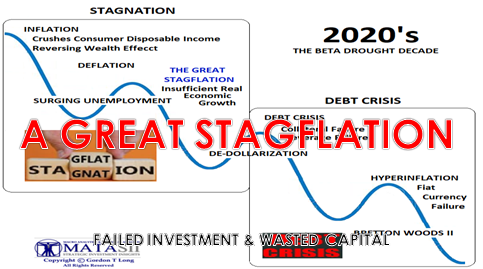

Why This Recession Is Different

All of these are structural dynamics that won't go away in a few months or years.Let's explore what's different now compared to recessions of the past 60 years.1. Deglobalization is inflationary. Offshoring production to low-cost countries imported deflation (product prices remained flat or declined) and boosted corporate profits.

Read More »

Read More »

The EU’s Crisis Is Global

The EU's crisis isn't limited to energy. It is a manifestation of the global breakdown of Neocolonialism, Financialization and Globalization. The European Union (EU) was seen as the culmination of a centuries-long process of integration that would finally put an end to the ceaseless conflicts that had led to disastrous wars in the 20th century that had knocked Europe from global preeminence.

Read More »

Read More »

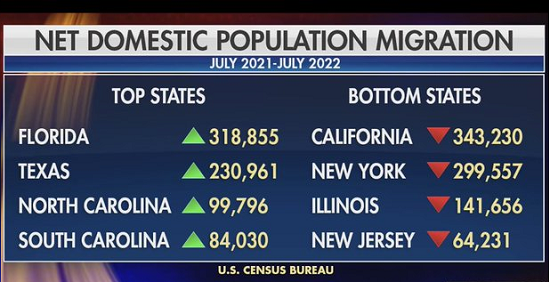

Why Some Cities May No Longer Be Viable

Any city whose lifeblood ultimately depends on hyper-globalization and hyper-financializationwill no longer be viable. The human migration from the countryside to cities has been an enduring feature of civilization.Cities concentrate wealth, productivity and power, and so they're magnets to talent and capital, offering newcomers the greatest opportunities.

Read More »

Read More »

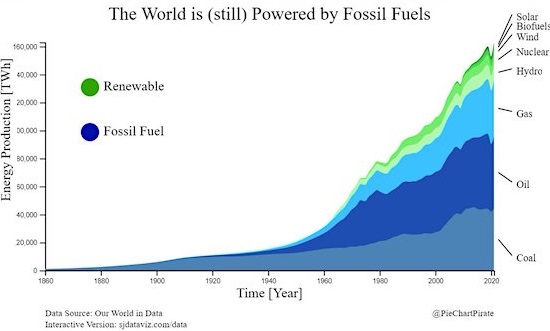

The Global Energy Crunch

If we insist on doing the transition the hard, slow, costly way rather than the easy, fast, cheap way, it's going to be a needlessly arduous, soul-crushing slog. Let's cover a few common-sense points and ask a few questions about the Global Energy Crunch.

Read More »

Read More »

The System Is Busy Cannibalizing Itself

As the word suggests, cannibalism won't end well for those consumed by the infinitely insatiable few. Cannibalize is an interesting word. It is a remarkably graphic way to describe the self-inflicted destruction of a system by stripping previously functional subsystems to sustain the illusion of system functionality. Here are some examples.

Read More »

Read More »

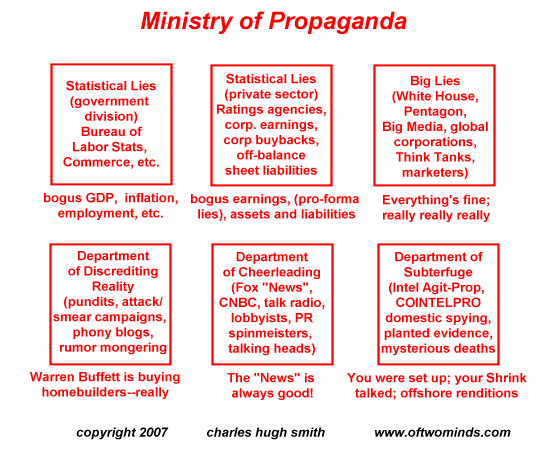

Make Sure You Download the Latest Ministry of Propaganda Updates

While it's fun to sort all the propaganda into various boxes, we would do well to look for what all the marketers / MoP players seek to mystify. It's time once again to check for Ministry of Propaganda updates, which like Windows and iOS is constantly being updated to counter new threats and enhance the user experience (heh).

Read More »

Read More »

The Roundtable Insight – Charles Hugh Smith on the Insanity of Central Banks in Addressing Inflation

Support us on Patreon - https://www.patreon.com/roundtableinsight

http://financialrepressionauthority.com/2022/08/26/the-roundtable-insight-charles-hugh-smith-on-the-insanity-of-central-banks-in-addressing-inflation/

Read More »

Read More »

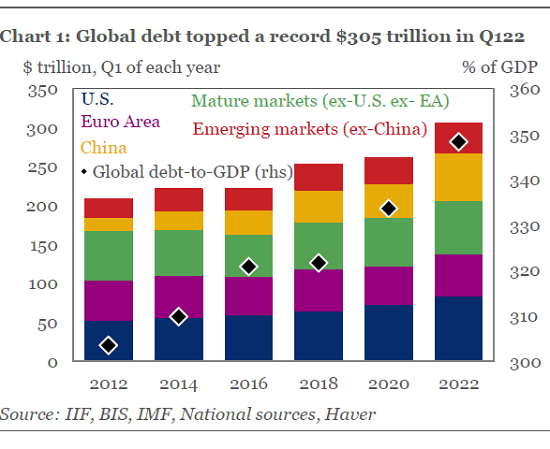

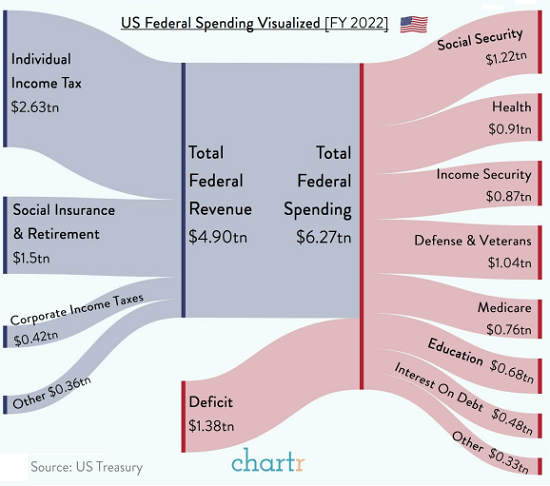

What’s Worse Than Inflation? Depression + Inflation

If "markets" controlled by the rich are allowed to distribute essentials, the result will be civil disorder and the overthrow of regimes. What's worse than inflation? Depression + Inflation. And that's where we're heading. As I explained yesterday in The Fed Can't Stop Supply-Side Inflation, central banks are trying to reduce inflation by crushing demand.

Read More »

Read More »

The Fed Can’t Stop Supply-Side Inflation

The Fed and other central banks have zero control of supply-driven inflation, period. America's financial punditry is bewitched by four fatal fantasies: 1. Inflation is demand-driven. If the Federal Reserve (or other central banks) reduce demand with monetary tools like raising interest rates, inflation will cool. 2. Substitution of high-cost goods with lower-cost goods reduces inflation, and substitution is infinite: there's always cheaper...

Read More »

Read More »

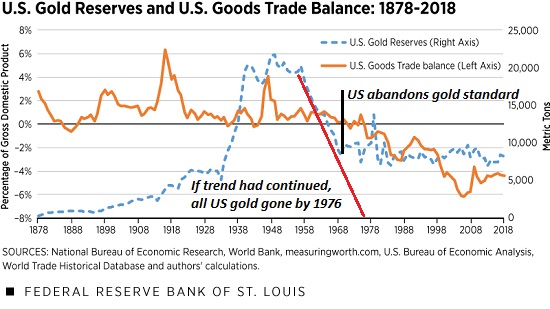

The Real Story of America Abandoning the Gold Standard

Even currencies maintaining convertibility to gold are still subject to bond yields, interest rates, trade and capital flows. It's widely held that all of our financial woes are the result of abandoning the discipline of the gold standard in 1971. The premise here is that if the U.S. had maintained the gold standard, the excesses of the fiat currencies regime could not have arisen.

Read More »

Read More »