Category Archive: 5.) Charles Hugh Smith

Risk Was Never Low, It Was Only Hidden

The vast majority of market participants are about as ready for a semi-random "volatility event" as the dinosaurs were for the meteor strike that doomed them to oblivion.

Read More »

Read More »

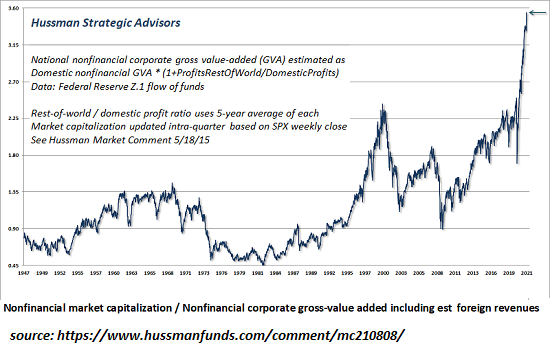

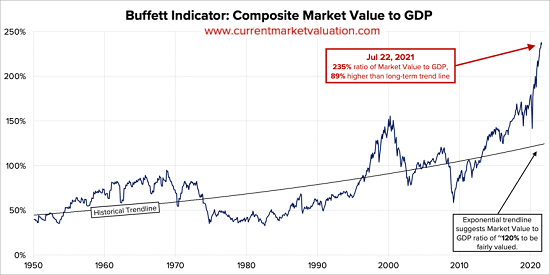

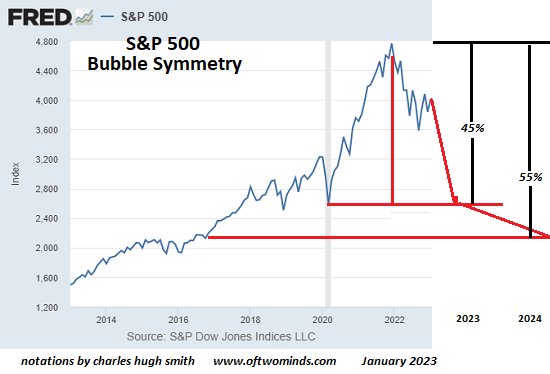

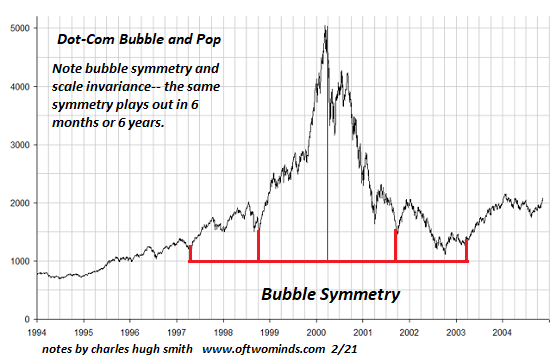

The Market Crash Nobody Thinks Is Possible Is Coming

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold. The ideal setup for a crash is a consensus that a crash is impossible--in other words, just like the present: sure, there are carefully measured murmurings about a "correction" but nobody with anything to lose in the way of public credibility is calling for an honest-to-goodness crash, a real crash, not a wimpy, limp-wristed dip that will...

Read More »

Read More »

Are We Really So “Rich”? A New Way of Defining Wealth

What if our commoditized, financialized definition of wealth reflects a staggering poverty of culture, spirit, wisdom, practicality and common sense? The conventional definition of wealth is solely financial: ownership of money and assets.

The assumption is that money can buy anything the owner desires: power, access, land, shelter, energy, transport and if not love, then a facsimile of caring.

Read More »

Read More »

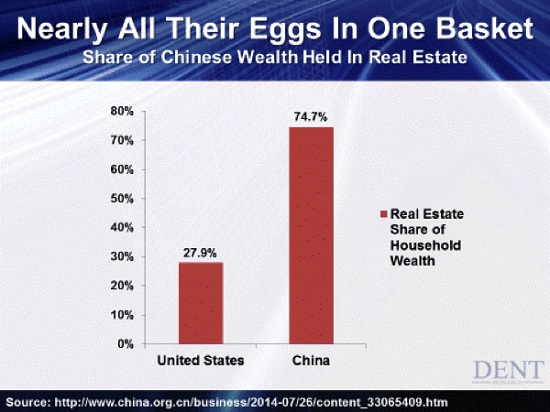

What’s Really Going On in China

Losses will be taken and sacrifices enforced on those who don't understand the Chinese state will no longer absorb the losses of speculative excess. Let's start by stipulating that no one outside President Xi's inner circle really knows what's going on in China, and so my comments here are systemic observations, not claims of insider knowledge.

Read More »

Read More »

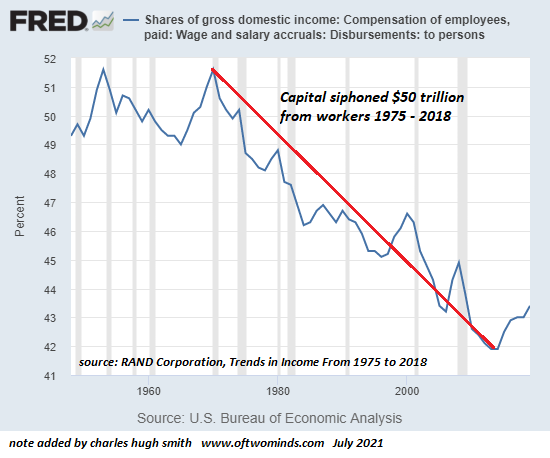

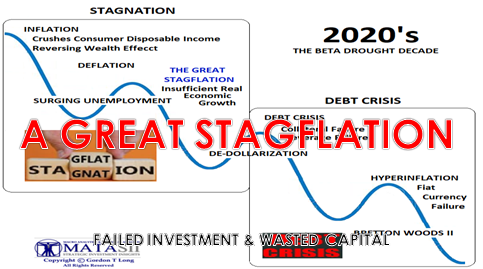

America 2021: Inequality is Now Baked In

This complete capture of all avenues of regulation and governance can only end one way, a kind of hyper-stagflation. Zeus Y. and I go way back, and he has always had a knack for summarizing just how insane,

disconnected from reality, manipulative and exploitive the status quo narrative has become.

Read More »

Read More »

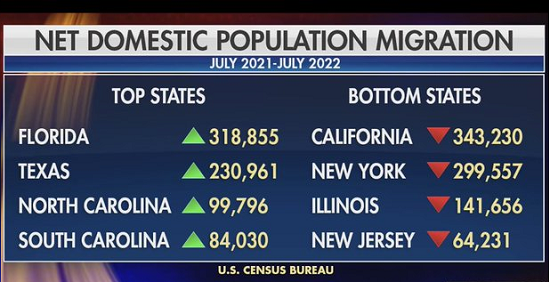

Now That the American Dream Is Reserved for the Wealthy, The Smart Crowd Is Opting Out

The already-wealthy and their minions are unprepared for the Smart Crowd opting out. Clueless economists are wringing their hands about the labor shortage without looking at the underlying causes, one of which is painfully obvious: the American economy now only works for the top 10%; the American Dream of turning labor into capital is now reserved for the already-wealthy.

Read More »

Read More »

Ministry of Manipulation: No Wonder Trust and Credibility Have Been Lost

Now that every financial game in America has been rigged to benefit the few at the expense of the many, trust and credibility has evaporated like an ice cube on a summer day in Death Valley.

Read More »

Read More »

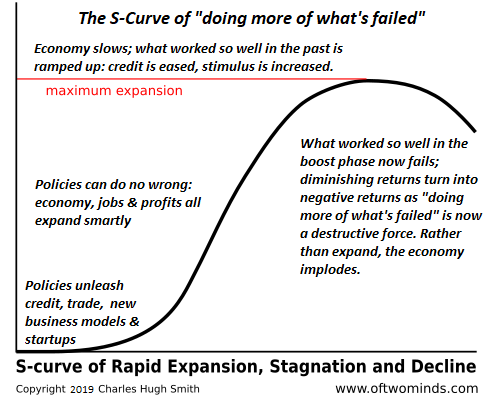

The Illusion of Getting Rich While Producing Nothing

By incentivizing speculation and corruption, reducing the rewards for productive work and sucking wages dry with inflation, America has greased the skids to collapse.

Read More »

Read More »

The U.S. Economy In a Nutshell: When Critical Parts Are On “Indefinite Back Order,” the Machine Grinds to a Halt

A great many essential components in America are on 'indefinite back order', including the lifestyle of endless globally sourced goodies at low, low prices. Setting aside the "transitory inflation" parlor game for a moment, let's look at what happens when critical parts are unavailable for whatever reason, for example, they're on back order or indefinite back order, i.e. the supplier has no visibility on when the parts will be available.

Read More »

Read More »

The Banality of (Financial) Evil

The financialized American economy and State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a putrid heap.

Read More »

Read More »

Please Don’t Pop Our Precious Bubble!

It's a peculiarity of the human psyche that it's remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble's inevitable collapse.

Read More »

Read More »

Charles Hugh Smith on Secular Inflation

Http://financialrepressionauthority.com/2021/08/26/the-roundtable-insight-charles-hugh-smith-on-secular-inflation/

Read More »

Read More »

The Upside of a Stock Market Crash

A drought-stricken forest choked with dry brush and deadfall is an apt analogy. While a stock market crash that stairsteps lower for months or years is generally about as welcome as a trip to the guillotine in Revolutionary France, there is some major upside to a crash.

Read More »

Read More »

The Smart Money Has Already Sold

Generations of punters have learned the hard way that their unwary greed is the tool the 'Smart Money' uses to separate them from their cash and capital.

Read More »

Read More »

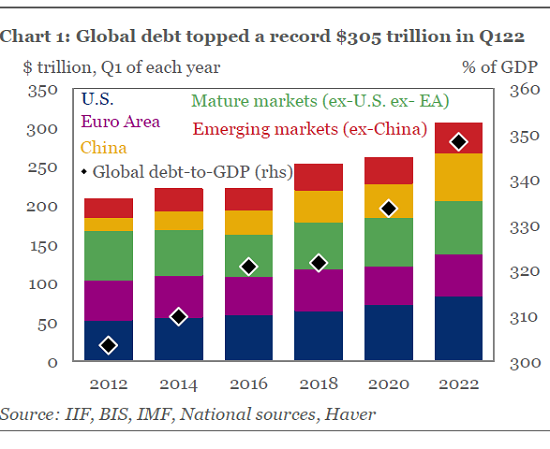

Why the Global Economy Is Unraveling

Global supply chain logjams and global credit/financial crises aren't bugs, they're intrinsic features of Neoliberalism's fully financialized global economy. To understand why the global economy is unraveling, we have to look past the headlines to

the primary dynamic of globalization: Neoliberalism, the ideological orthodoxy which holds that introducing market dynamics to sectors that were closed to global markets generates prosperity for all.

Read More »

Read More »

Dear Fed: Are You Insane?

So sorry, America, but your central bank is certifiably insane, and it's not going to magically work out. History definitively shows that speculative bubbles always pop--always. Every speculative

bubble mania, regardless of its supposed uniqueness--"it's different this time"--pops.

Read More »

Read More »

The End of Global Tourism?

Viewed as a complex non-linear system, the pandemic varinants can only be controlled by drastically pruning the physical connections between disparate global groups, which means effectively ending the unrestricted flow of individuals around the planet.

Read More »

Read More »

While the Herd Slumbers, Risk Is Rocketing Higher

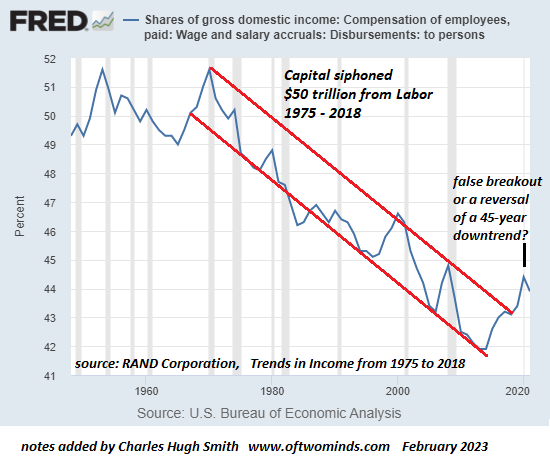

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy.

Read More »

Read More »

The Moment Wall Street Has Been Waiting For: Retail Is All In

The ideal bagholder is one who

adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding

on for the inevitable Fed-fueled rally to new highs.

Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not

the Federal Reserve: the old hands have been waiting for retail--the individual investor--

to go all-in stocks. After 13 long years, this moment has finally arrived:

retail is...

Read More »

Read More »

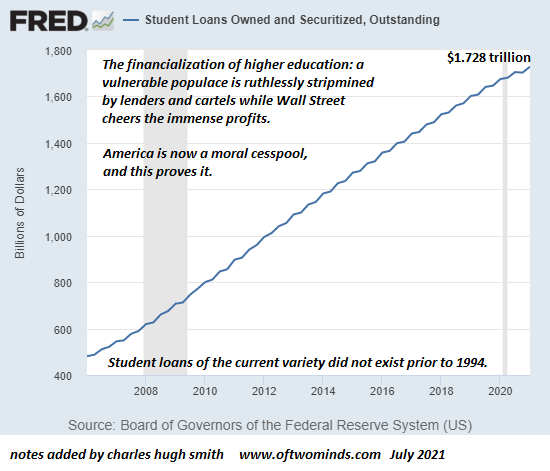

America Is a Moral Cesspool, and Student Loans Prove It

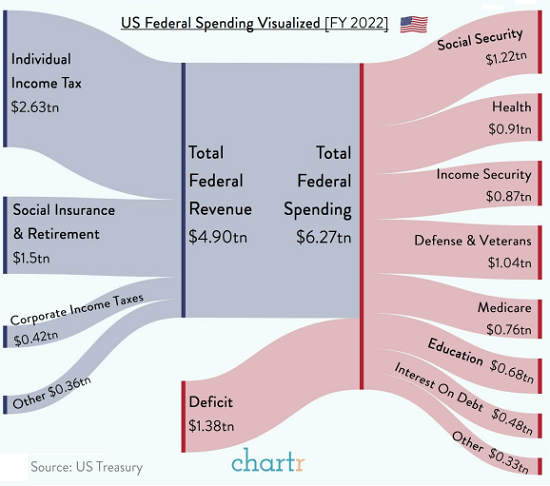

If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now "impossible" to do so, even as America's wealth and gross national product (GDP) have both rocketed higher over the past 27 years?

Read More »

Read More »