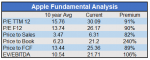

Passive Fingerprints Are All Over This Crazy Market. Apple’s stock is up over 20% since the market peak in February. Without a doubt, Apple, the company, is worse off due to the crisis and global recession. Revenue and earnings will be inferior to what Wall Street had forecast at lower stock prices. Valuations, shown below, are now astronomical.

Read More »2020-07-16