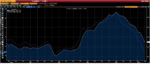

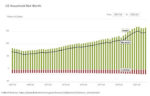

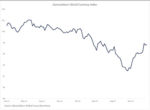

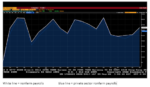

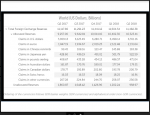

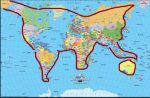

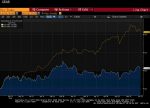

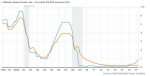

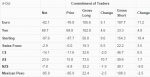

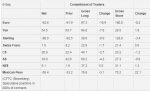

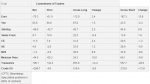

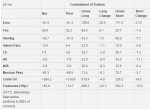

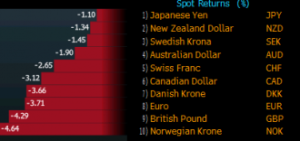

The Bannockburn’s World Currency Index (BWCI) is a

GDP-weighted currency basket representing the currencies of the top 12

economies, with the eurozone counted as one.

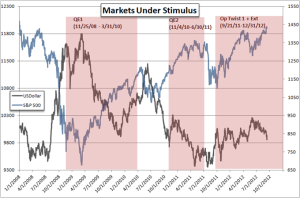

The US is the world’s largest economy and the dollar’s share

of the index is almost 31%. China is the second-largest economy and has a

nearly 22% weight.

The euro is next with a 19% weight, followed by Japan with

about a 7.5% weight. After that, the weights drop off to less than 5% for the

other members.

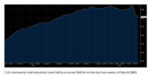

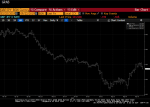

It has risen, meaning that the foreign currencies have risen

against the dollar, by about 5.4% since forging a bottom late last year.

It has recouped about half of what it lost since peaking in

June 2021.

Because of the dollar’s large role, it is more of a

confirmation indicator than leader in trend changes.

Read More »