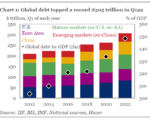

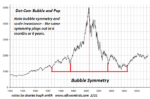

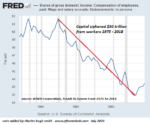

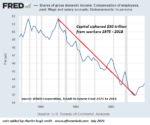

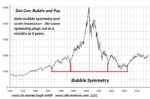

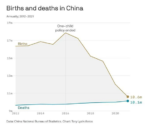

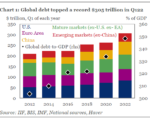

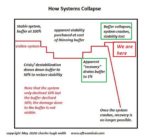

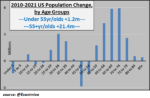

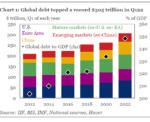

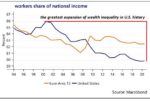

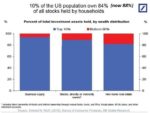

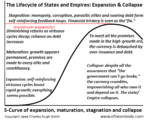

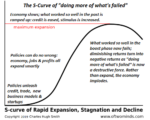

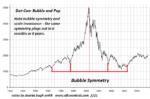

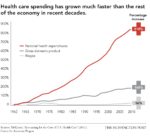

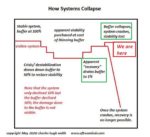

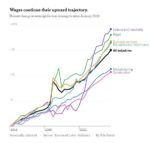

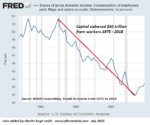

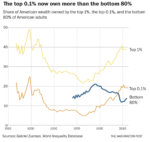

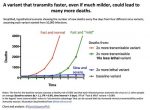

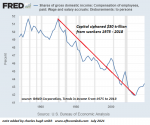

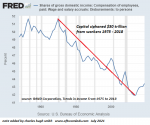

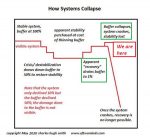

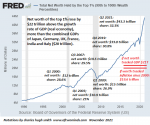

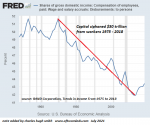

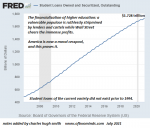

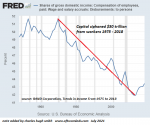

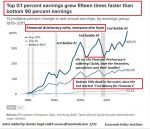

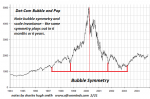

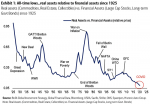

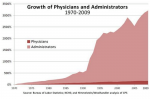

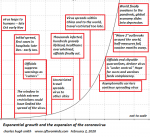

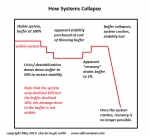

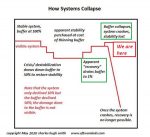

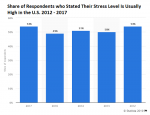

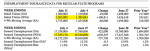

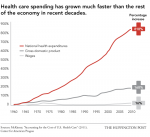

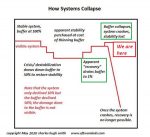

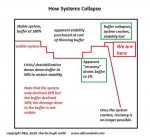

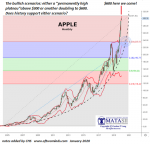

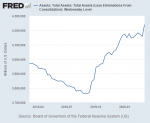

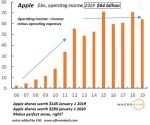

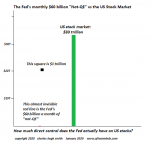

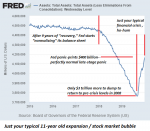

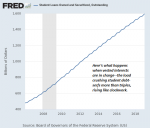

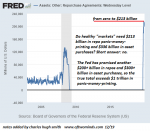

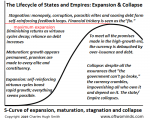

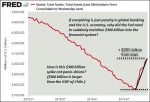

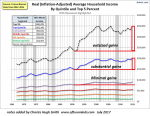

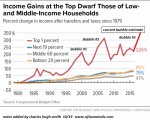

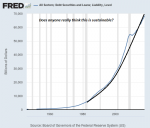

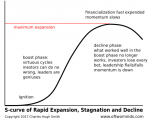

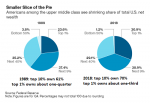

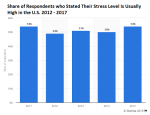

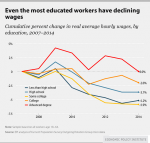

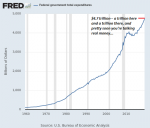

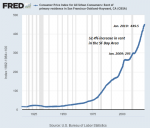

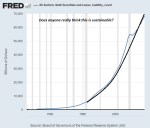

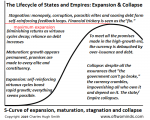

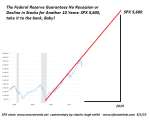

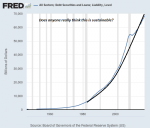

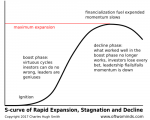

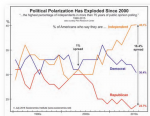

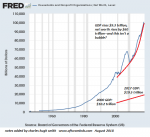

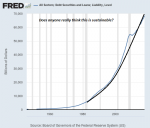

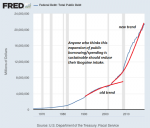

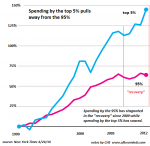

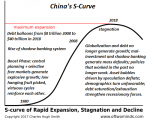

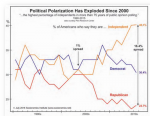

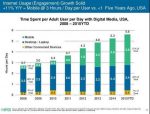

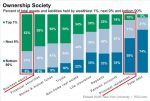

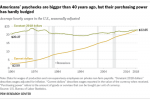

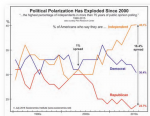

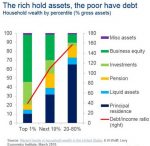

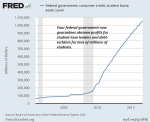

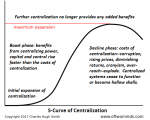

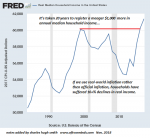

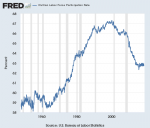

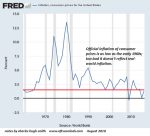

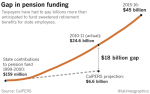

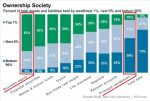

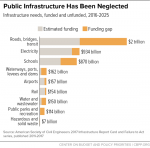

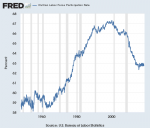

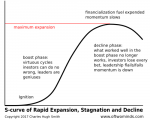

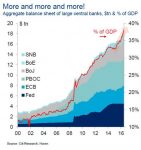

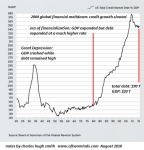

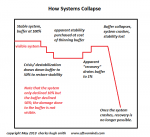

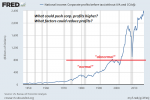

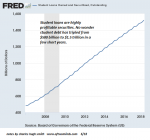

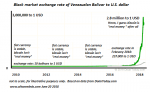

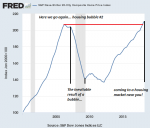

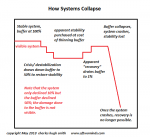

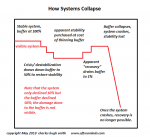

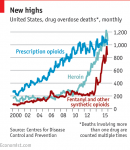

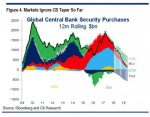

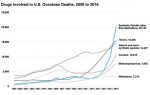

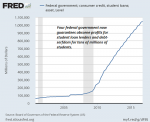

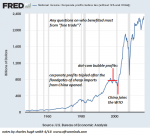

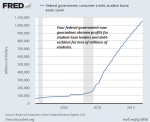

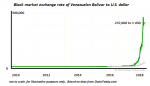

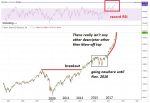

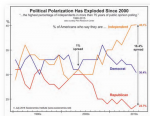

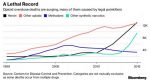

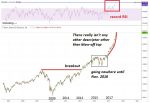

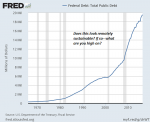

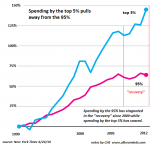

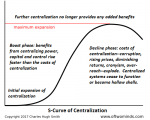

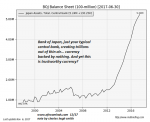

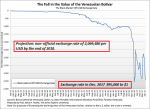

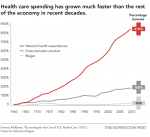

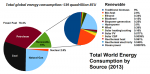

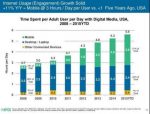

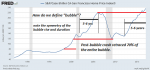

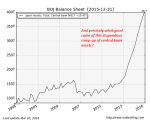

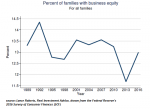

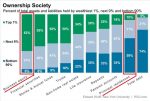

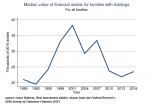

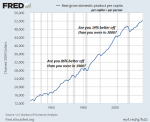

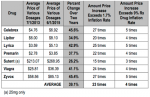

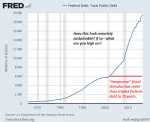

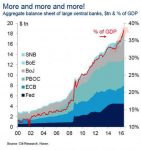

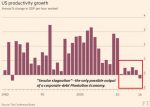

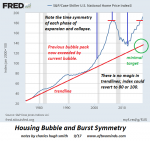

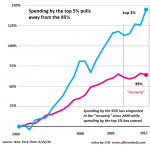

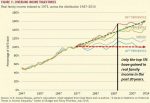

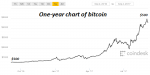

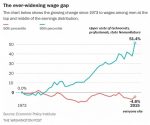

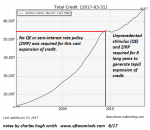

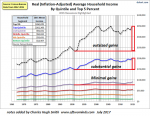

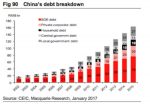

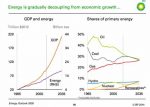

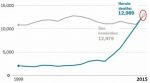

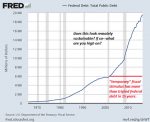

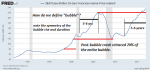

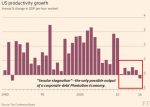

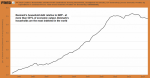

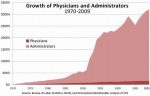

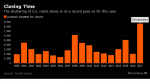

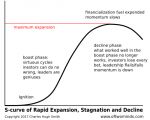

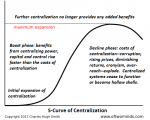

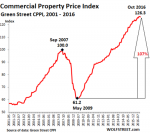

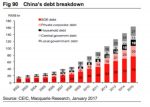

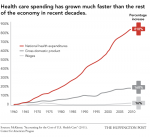

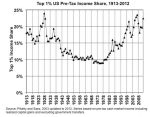

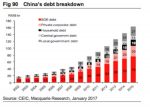

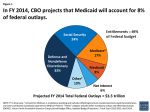

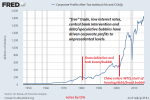

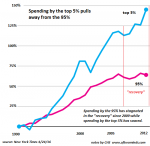

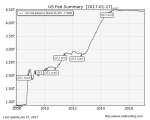

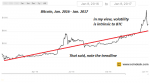

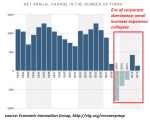

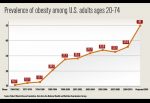

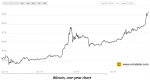

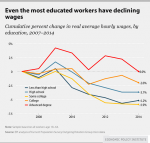

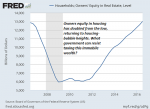

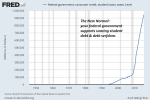

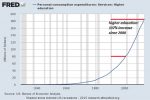

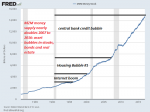

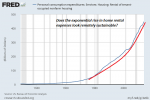

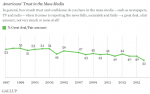

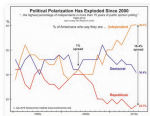

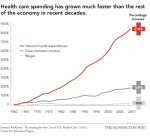

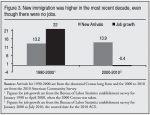

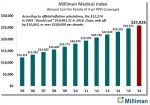

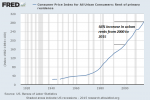

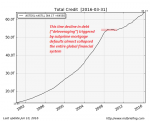

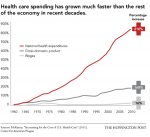

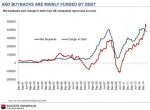

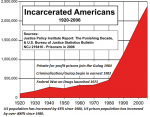

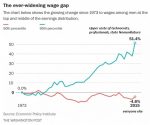

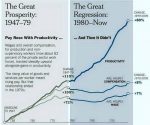

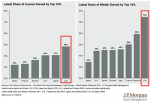

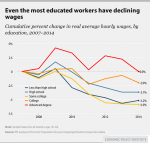

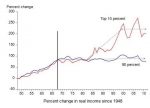

These charts reflect a linear system that is wobbling into the first stages of non-linear destabilization.

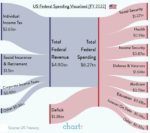

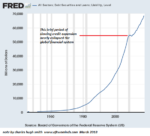

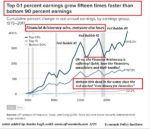

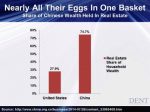

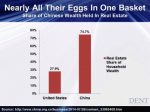

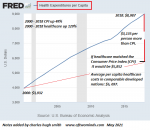

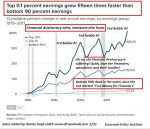

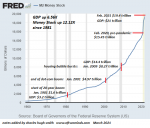

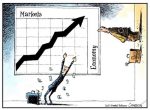

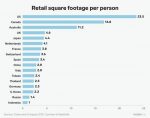

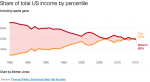

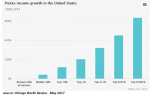

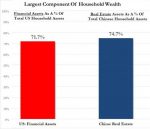

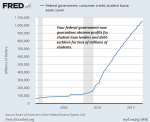

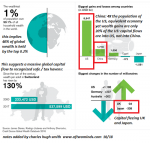

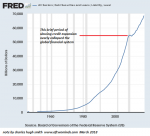

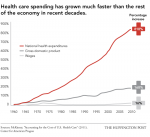

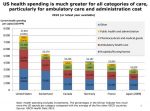

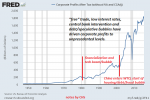

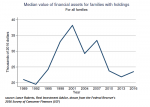

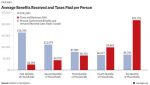

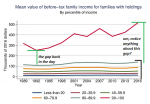

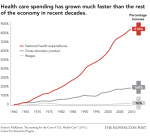

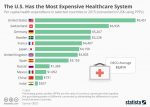

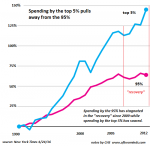

The widespread presumption is the U.S. is wealthy beyond words, and will remain so as far as the eye can see: wealthy enough to fund trillion-dollar weapons systems, trillion-dollar endless wars, multi-trillion dollar Medicare for all, multi-trillion dollar Universal Basic Income, and so on, in an endless profusion of endless trillions.

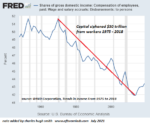

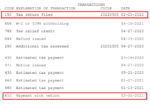

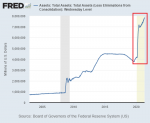

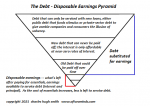

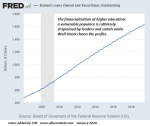

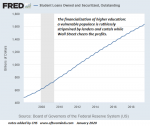

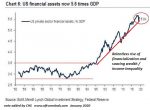

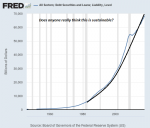

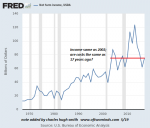

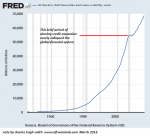

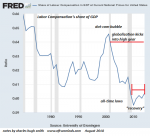

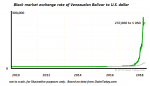

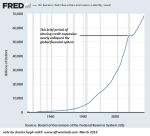

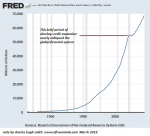

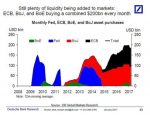

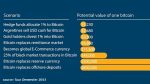

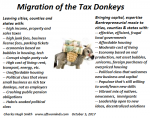

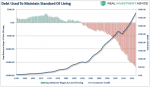

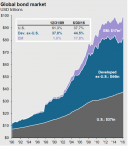

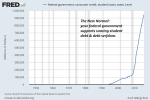

Just as a thought experiment, let’s ask: how “wealthy” would we be if we stopped borrowing trillions of dollars every year? Or put another way, how “wealthy” would we be if the rest of the world stops buying our trillions in newly issued bonds, mortgages, auto loans, etc.?

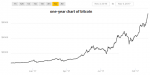

The verboten reality is our “wealth” is nothing but a sand castle of debt.

Read More »