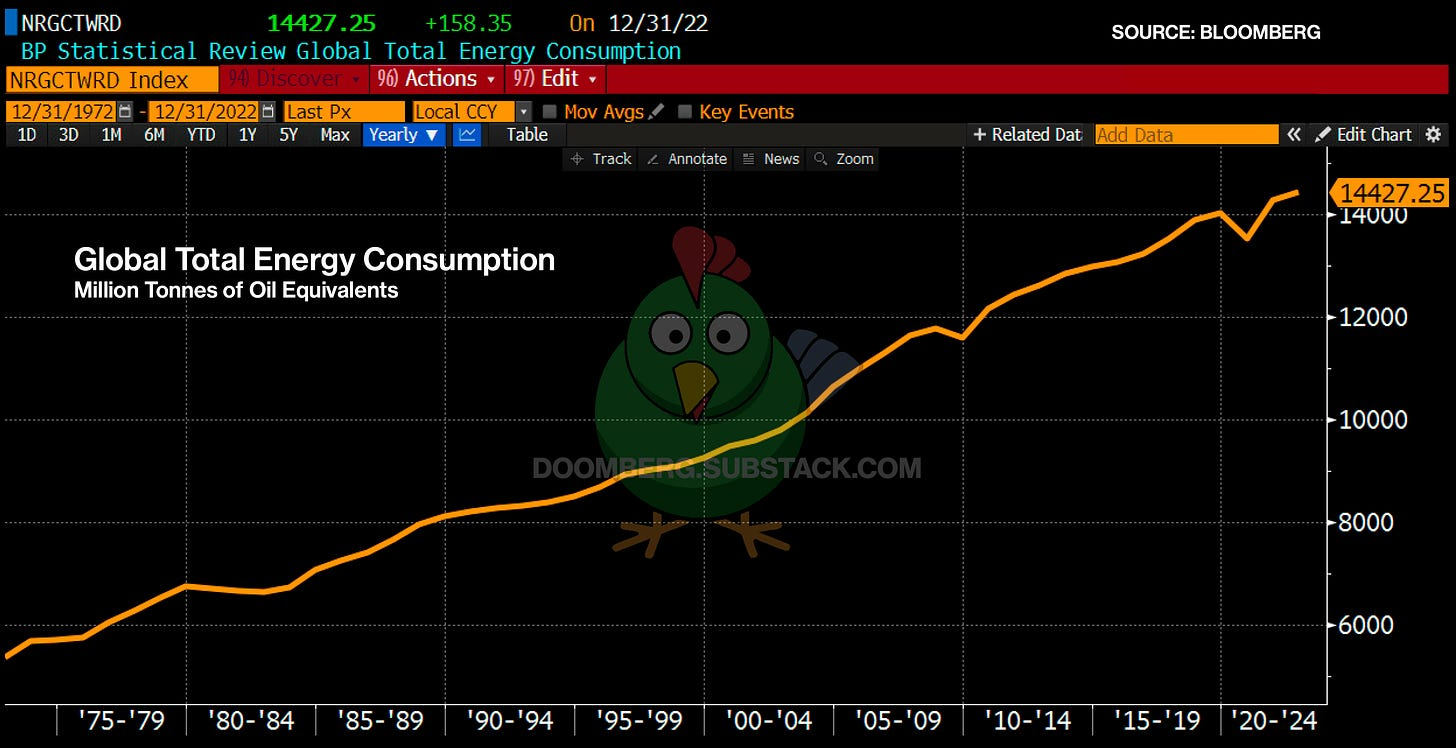

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out.

You see inflation around you; anyone can only tell deflation by hopefully noticing and appreciating what must instead be absent (a poignant reminder for US Labor Day).

| People with the means don’t sit idly by for either affliction.As to the former, inflation, as noted here investments and activity will flow from the financial to the real. Commodities do particularly well and in that sense they can tell us something about the underlying aggregate opinion of those doing the investing.

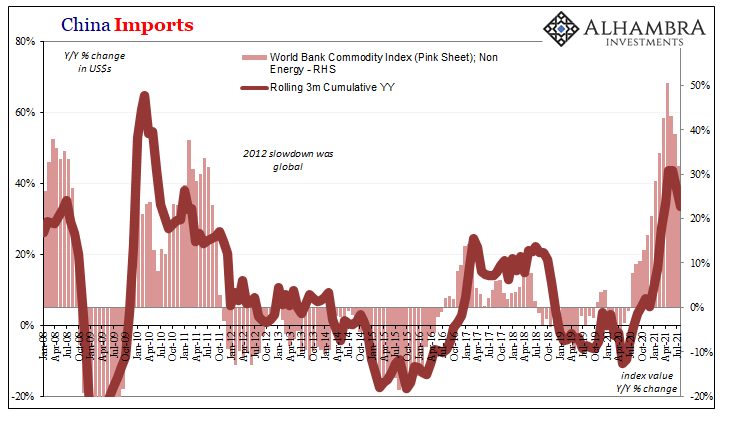

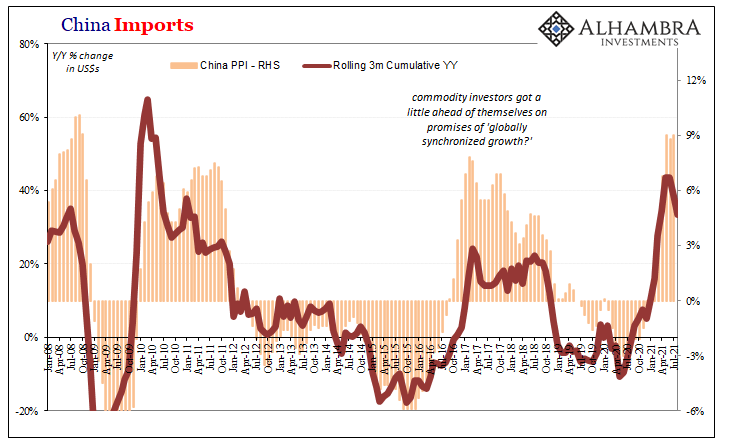

Inflation, or something else? There are, however, real components mixed up in commodity prices. Yes, supply factors balanced against real economy demand before then being spliced into any perceptions money-wise. Given the real-ness of these prices, would it really surprise anyone that commodity costs seem to correlate very highly with the marginal pass-through economy in China? The Chinese system has for decades acted as the central nexus between the developed world buying manufactured goods made there and the developing, more-resource oriented systems sending raw material to China in order to do the manufacturing. |

|

| The latter is and was augmented by how much building inside China the Chinese needed or might still need in order to remain stable in this middle real economic ground.

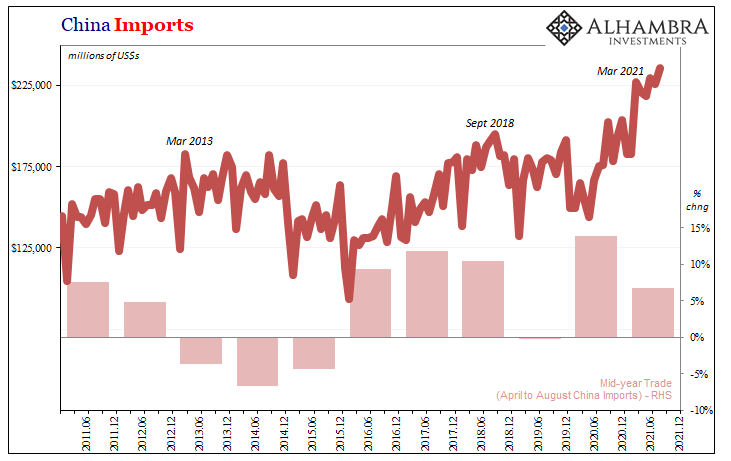

Build China so China could build all the things. This had meant a huge, sustained influx of those raw materials. The more and faster the Chinese built, the more likely commodity prices in their real sense would be bid upward, too. US QE not much difference (because, in the end, it is not money printing). Therefore, a relatively stable – even visible – correlation between global commodity prices (in US$’s, of course) and the rate of additional Chinese imports. The more that China demanded from the rest of the world, the more demand for commodities against relatively less elastic supply. See for yourself: |

|

| Setting aside notions of “money printing” here, what we see is slowing in both – though the extent of potential deceleration in China imports is more difficult to parse given base effects in the numbers.

Commodity prices have come off their sizzling boil, of course, but the question is whether or not this is some temporary pause in what many have called the beginning of a supercycle. For something like that to happen, “money printing” on the one hand and a resurgent China on the other. This is why, for inflation narrative purposes, China is always classified as the strongest economy (whether it is or not). How might we know in terms of Chinese imports? That country’s General Administration of Customs (GAC) doesn’t provide any seasonally-adjusted monthly figures. |

|

| Instead, we’re left to calculate something similar of our own.

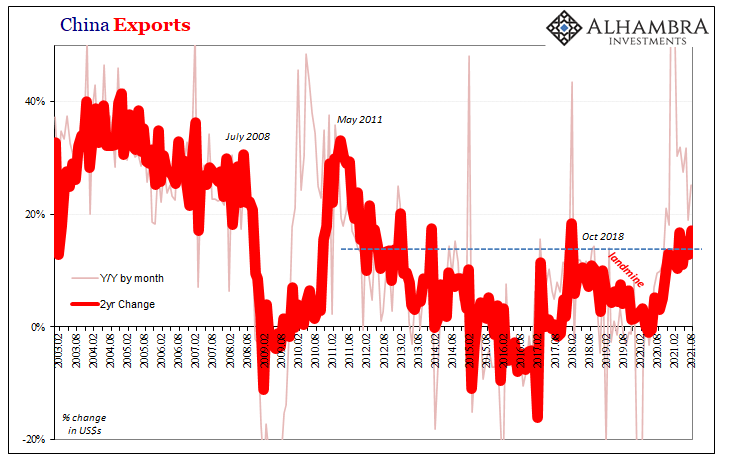

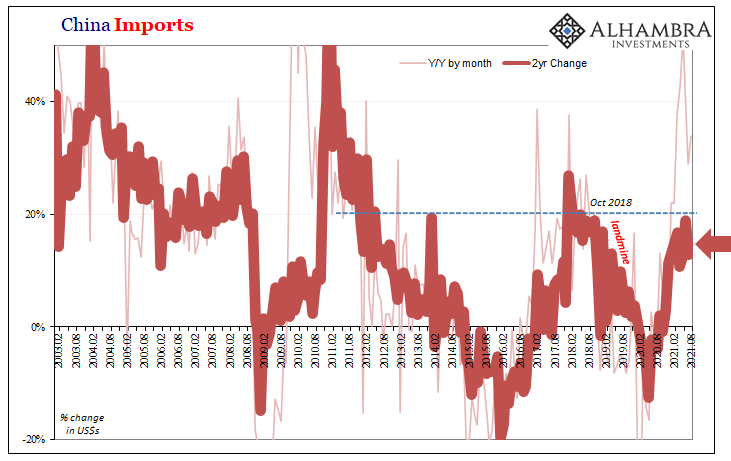

First, though, the raw data. For the month of August 2021, estimates released today, GAC puts record highs for both exports out of China as well as inbound trade coming in. That’s neither a big deal nor is it a useful description; how fast and how far from one record high to the next. According to Customs, the year-over-year rate of change for exports was 25.6%, while for imports 33.1%. Yet, those include large base effects from low comparisons with last year’s recessionary hole. |

|

| For imports, therefore commodity and inflation potential, the 2-year change a paltry 14.5%. Why is nearly 15% “paltry”? It is less than the rate from 2018’s not-nearly-enough imported trade, and nowhere near the initial “recovery” period during the immediate aftermath of the Great “Recession.” The former never did provide enough growth and momentum to keep 2017’s globally synchronized growth dream from collapsing hard by late 2018.

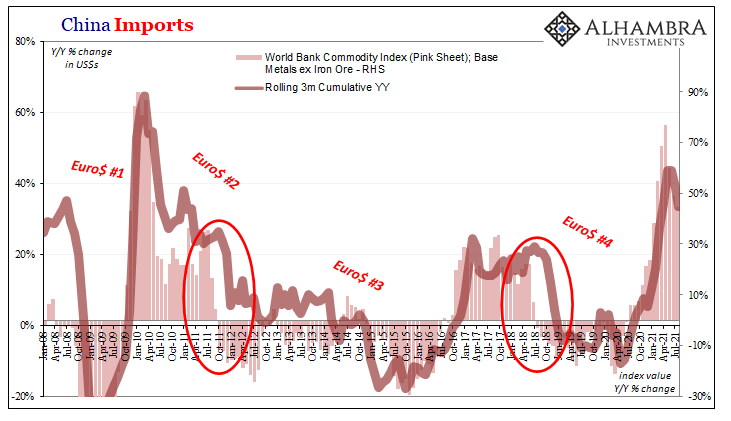

And it was the opposite of “money printing” which doomed the whole period (Euro$ #4). What we find currently are not the growth rates anyone should associate with a recovery let alone a real inflationary boom extending well beyond one. |

|

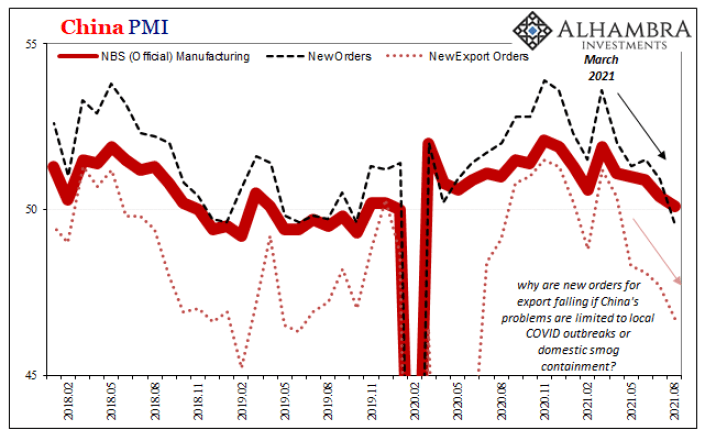

| In addition to those wider-spaced comparative paces, there’s also the growing question about more recent slowing; second derivatives. If Chinese imports (or exports) aren’t really robust in the longer-run sense, what about a possible turnaround in the more immediate calendar?

Again, while there aren’t seasonally-adjusted monthly data values, we can look back through recent years and compare the changes between specific months, say, after April and through the end of August each year. The same seasons. What we find in doing so is that, yes, there does appear to be some significant slowdown in the more recent pace of Chinese import activity (undoubtedly some will blame COVID and port bottlenecks). The difference from May through August (inclusive) 2021 compared to the same months in 2020 is just more than 6%. Last year it was almost 14% (May-Aug 2020 vs. May-Aug 2019). |

|

| During the two years of “globally synchronized growth” (2017 & 2018) as well as the one preceding them (2016) when China was last hopped-up on heavy doses fiscal and monetary “stimulus”, these same short run rates were each in the double digits. Instead, mid-year 2021 has turned out more like mid-years 2011 and 2012, which back then had emptied out the last commodity “supercycle” of anything real behind that same rhetorical promise.

And it had been emptied out by, previously, the opposite of “money printing” (Euro$ #2). Up to August 2021, then, Chinese imports have not really been all that robust to begin with and there is growing evidence even so the best days might be behind. |

|

| Nothing here proves this to be the case, of course, and four-month comps can be equally as noisy as any month-to-month (and there’s always questions about data from China).

Still, when it comes to the “real” piece of commodities insofar as real demand goes, there’s much which does vigorously correlate prices to real economy. |

And if China’s economy really is cooling off despite never really heating up all that much (instead, supply issues in prices), there goes the supercycle leaving mere “inflation” to depend more comprehensively on the “money printing” aspect alone.

Which is to say, pretty likely transitory.

Full story here Are you the author? Previous post See more for Next post

Tags: China,commodities,currencies,Deflation,economy,exports,Featured,Federal Reserve/Monetary Policy,global trade,imports,inflation,Markets,newsletter,PPI