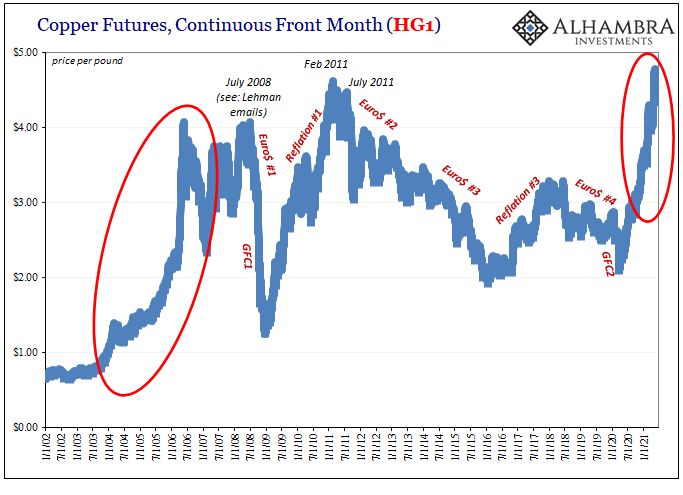

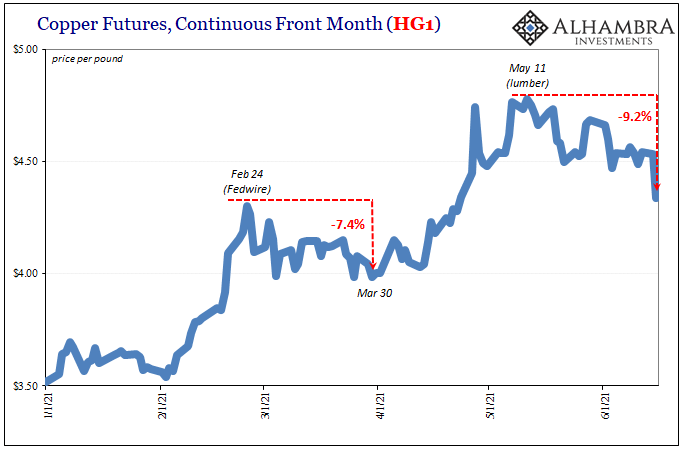

| Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Is this just another modest fluctuation in a market just getting started on the upside (super-cycle)? After all, going back a few months earlier the Fedwire mess (Feb 24) had tripped up copper’s circuit, interrupting its moonshot at least for about five weeks. The cumulative decline during those was a bit more than 7% – and then right back to the 45-degree ascent. |

Copper Futers, Continuous Frn Month, Jan 2002 - May 2021 |

PPI Copper Recent, Jan 2021 - May 2021 |

|

| It’s possible that’s all what’s going on in copper and other commodities at the moment – correction time for a super-cycle still in its earliest stages. Those begging inflation believe this, but that’s where the lumber story makes it interesting; increasing uncertainty about that other perspective.What happens when supply drips out? This has been the looming hammer; in lumber, that has finally meant new supply of new material. In copper, this could take the form of de-hoarding huge built-up inventories that were stockpiled, on low prices, in the immediate wake of last year’s collapse. If prices threaten to go too far in the wrong direction, we’d expect this destocking to pick up and maybe snowball. |

CME Random Length Lumber Futures, Jan 2020 - May 2021 |

| While we obviously can’t say for sure which one it is, no one knows in the short run, the fact that it’s now a more probable possibility only raises the stakes for “transitory inflation” (which, again, isn’t inflation). This had always been the baseline case, even as commodities were screaming into the stratosphere, but the probabilities have been further boosted by several recent developments – now including lumber and copper.

For one, as pointed out in yesterday, the huge difference between US inflation and Europe’s (or Japan’s and China’s). Consumer prices throughout the rest of the world are solidly uniform in being unable to break out, instead it has been the American set which continues to be the outlier. If what we are seeing right now had been actual, legit monetary inflation – all that “money printing” – then European consumer prices (as well as those in China and Japan) would be sticking right with their high-level US counterparts. |

U.S. and Europe Consumer Prices, Jan 2007 - Apr 2021 |

| Thus, also as noted yesterday, almost certainly supply factors given what have been big and temporary differences in rebounding demand. Uncle Sam and his checkbook.

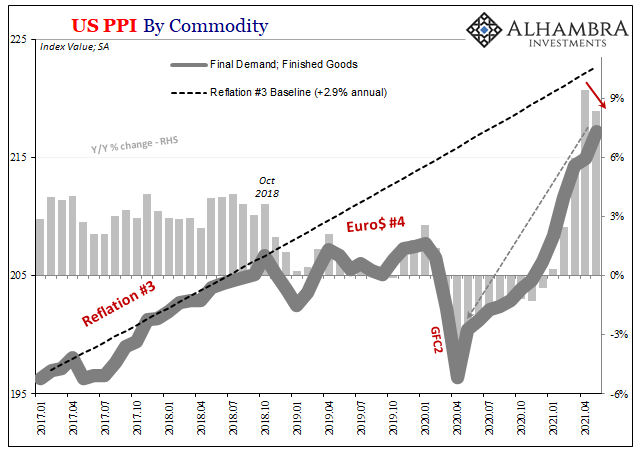

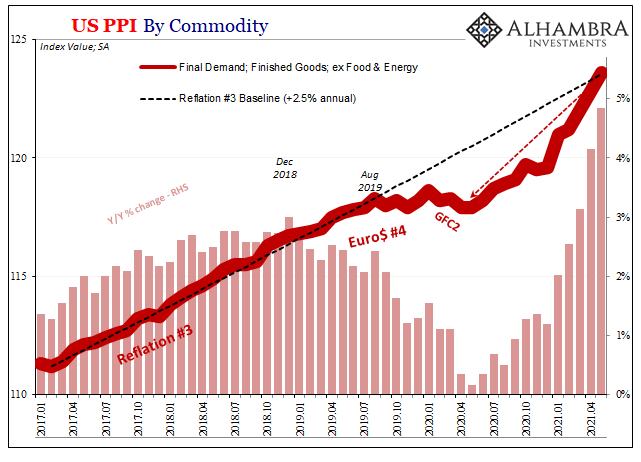

Where price behavior has been consistent from the US to Europe and Asia has been producer prices. These are more directly about commodities and their influence as key input costs. The American PPI hasn’t been much different than the European, for example, each accelerating and going upward unchecked. |

Supply and Demand Curves EA/US |

| In addition to commodity influence, though, also base effects. The US PPI, with updated estimates for May 2021 released by the BLS today, may have already peaked.

Because the trough for this price index had been registered back in April 2020 rather than last May, the year-over-year increase in April 2021 (+9.42% y/y) was greater than last month’s (+8.38% y/y). |

U.S. PPI Finished Goods, Jan 2017 - May 2021 |

| The so-called core PPI went a little farther upward given that its trough was equal last year both April and May. Therefore, this one set a new record high.

Next month, what’s happened in June thus far indicates more toward the downside. Not only are base effects going to diminish, there are already less favorable commodity price comparisons becoming even less favorable still (outside of crude oil, of course). Unless lumber and copper (and others) stage a furious rebound in the second half of this month, the next stage of “transitory inflation” will show up in every set of June producer prices (as well as consumer prices). In other words, this is playing out almost exactly in the way a supply shock would; including the predictable (and predicted) overhyping of the “inflation” numbers as each one was released. |

U.S. PPI Finished Goods Core, Jan 2017 - May 2021 |

As I wrote at the end of last year, specifically referencing copper’s already sharp appreciation:

|

US PPI All Commodities, Jan 2001 - May 2021 |

Japan and Germany PPI JGB, Nov 2020 - May 2021 |

|

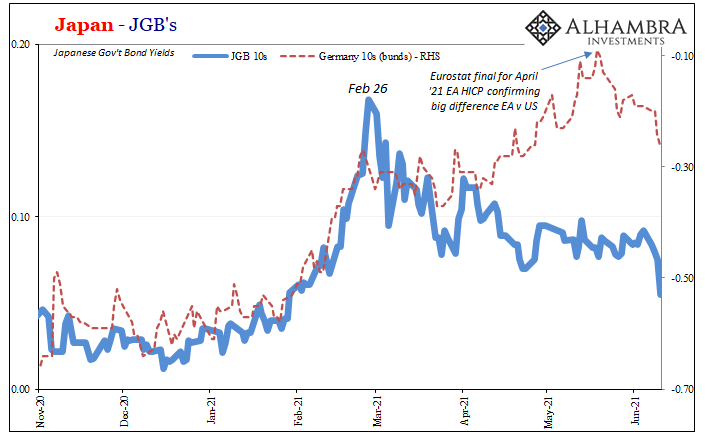

| Again, this point has been further reinforced by the US consumer price index being such an obvious outlier – this cannot be overstated. In fact, Europe’s depressingly small flash HICP estimate for March was released on the 20th of that month – just a few days after UST yields broke out of reflation. Then Europe’s further lackluster HICP for April was confirmed on May 19, representing the most recent top in German bunds.

Each of those reports almost surely contributed something to the more serious anti-reflation in global bonds. |

Japan and US PPI JGB, Nov 2020 - May 2021 |

Now there is a gaining possibility that commodities other than oil aren’t going to contribute nearly as much as they had during those months; substantially less. This could change, turn out to be nothing more than a temporary correction, but right now it’s all going to pattern.

Taking account of all these things, again, small wonder bond yields globally have ignored one huge American “inflation” number after another – including today’s US PPI. Transitory just may have been baked into it from the very beginning, except the topic of inflation is more about emotion and revenge than it is economic (small “e”) analysis.

When Jay Powell – Jerome freakin’ Powell – has become the voice of reason, you know the whole issue has gone way off center. If only because more and more it does appear how inflation, real inflation, has not.

Full story here Are you the author? Previous post See more for Next post

Tags: bond yields,Bonds,commodities,Consumer Prices,Copper,CPI,currencies,Deflation,economy,Europe,Featured,Federal Reserve/Monetary Policy,hicp,inflation,Markets,newsletter,pce deflator,producer prices