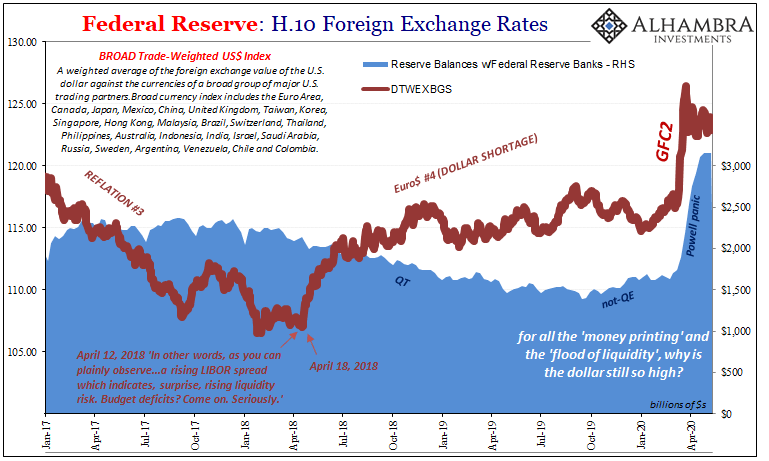

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered.

In second place (now third) for the dollar’s best, Q4 2008.

You might be getting the sense that when the dollar goes up only bad things happen, the dollar’s best when the world is pushed to its worst.

It doesn’t quite fit with all this “strong” dollar nonsense that some still take seriously.

Lorie Logan, FRBNY Executive VP and current System Open Market Account Manager, wrote at the end of March the opposite of “we saw it coming.” Jay Powell, as you might be aware, booked himself into appearing on CBS News’ 60 Minutes program last Sunday where he proceeded to tell one blatant lie after another.

Beginning with “so, we saw it coming.” What was “it?” Let’s ask Ms. Logan:

Amid heightened demand for dollar funding, foreign exchange swap basis spreads of key U.S. dollar currency pairs widened significantly and temporarily reached levels last observed during the global financial crisis.

They knew this was going to happen, but they also let it get so out of hand it could only be compared with GFC1? We were prepared but it happened anyway isn’t quite the argument you think. Nice try, Jay.

At this point, though, it at least sounds better than admitting they we weren’t prepared at all and that’s why it wrecked everything.

Leave it to FRBNY to provide the counterexample to the progress in the mainstream I noted earlier this week in identifying what’s really behind every financial curtain. While some in the media have correctly picked up on the theme dollar shortage, this recognition isn’t quite universal nor has it yet taken center stage at the central bank. The idea of “flight to safety” is still prominent in the dollar’s explanation provided by the Open Market Desk – even though there’s much amiss about it (interest rate differentials a key counterpoint).

The dollar’s large appreciation was primarily driven by safe-haven flows stemming from sharp reductions in both the global growth outlook and overall risk sentiment amid the uncertainty of the path and duration of the novel coronavirus (COVID-19) outbreak… The dollar still appreciated over the quarter despite U.S. interest rate differentials narrowing notably relative to other advanced economies, as the safe-haven status of the dollar dominated interest rate differential considerations.

|

No, “safe-haven” status especially in this kind of negative carry situation can’t account for why, for example, the US$ would appreciate against, say, the euro. The answer to what makes the dollar so special that it stands out amongst a group that includes Germany has less to do with any haven than it does how available which particular currency might have become. And how and how widely they are normally used (the real stuff behind a global reserve). Which, by the way, Ms. Logan actually gets to:

It wasn’t “another key component” it was the key. Period. And it was characterized by broad dysfunction beyond these massively negative basis premiums (swaps). These things, liquidity markets, are all interconnected, domestic as well as offshore. If FX markets are this bad, what do you think is really going on in repo (collateral first)? No need to answer, even the stock market found out. |

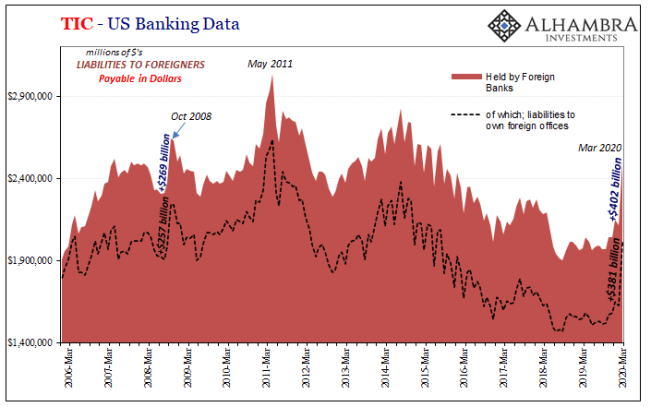

TIC - US Banking Data, 2006-2020 |

| That’s how these fire-sale liquidations, like those during Q4 2008, become universal across the planet.

The global in global financial crisis, in other words.

It’s the last sentence above, the one I’ve highlighted, which is really the whole point in this review exercise. More than anything, I think, it explains the ridiculousness and absurdity of the Federal Reserve and it’s play acting in this monetary realm. Overseas dollar swaps. Conceptually, first, any strong desire to hold expensive dollar liquidity buffers is drawn from serious mistrust of systemic conditions – including the central bank’s place in them. If you thought Jay Powell well prepared in advance with effective countermeasures standing at the ready, buffers of any size need not apply. If instead you thought the Fed Chair and all his minions the very example of bungling idiots, dollar buffers galore. At any size, bigger the better. And, if the latter, you wouldn’t care as to where you found the source of any additional liquidity, you’d just go get it – such a domestic banks putting into action their foreign subsidiaries in bidding at overseas central banks offering US dollar auctions deriving from the Fed’s overseas dollar swap programs. |

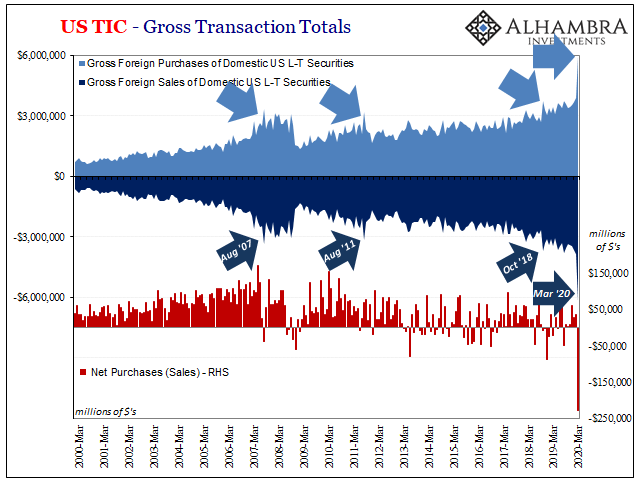

US TIC - Gross Transaction Totals, 2000-2020 |

As I wrote on Monday:

Think about how bad the Fed must be at its job when, as a domestic bank authority, US domestic banks under it, first of all, feel the necessity of accumulating a massive, disruptive liquidity cushion and, second, have to go overseas to get it! And both recent times this has happened, to such an extreme, the dollar has done what? Its best at the system’s worst. Thus explains two important points simultaneously – why the dollar remains so high despite the Fed’s “flood” of “liquidity” and why Jay Powell lied his ass off last Sunday. Actually, those two things are really the same thing: they really have no idea what they are doing, at least when it comes to monetary competency. |

Federal Reserve: H.10 Foreign Exchange Rates, 2017-2020 |

What the Fed does do well it does very well. This just has nothing to do with the monetary system directly:

Powell said Sunday something specific about a digital money printer – and the media went nuts with it, filing story after story. Yet, the strong dollar remains – as do other “safe haven” signals like bond yields and deflation expectations in TIPS. |

|

Proving the point yet again: it’s not what you see on the Fed’s balance sheet that actually matters, it’s what you don’t see which really does. And while we can easily observe the fruits of Jay Powell’s puppet show in the massively expanded balance of bank reserves, we can’t directly make out the more important monetary substance except by way of all these market signals.

If you know how to properly interpret and evaluate them. DOLLAR UP = BAD. The dollar’s still up

Full story here Are you the author? Previous post See more for Next postTags: currencies,dollar,economy,EuroDollar,eurodollar system,Federal Reserve/Monetary Policy,federal-reserve,global dollar shortage,jay powell,Markets,newsletter,tic