| If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?

Not for nothing, every couple years when we do those (record low yields) that’s what “they” always say and yet they only ever go lower the next time. But what do we mean by “the next time?” Before getting into it, the central bank simply doesn’t factor. |

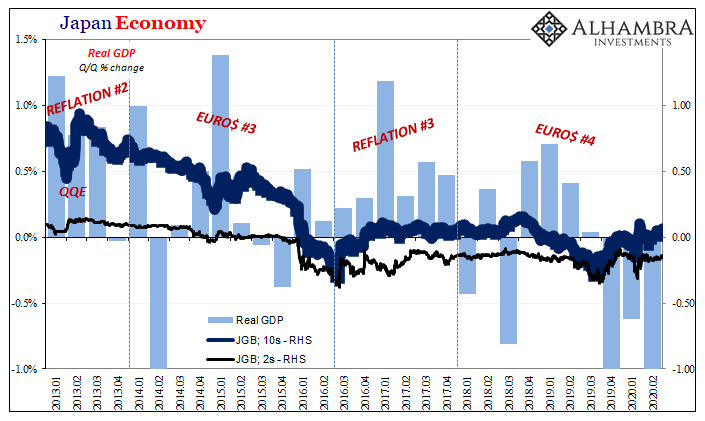

Japan Economy, 2013-2020 |

| Monetary authorities possess no monetary abilities therefore they follow along with what bond markets are already doing. Sometimes that means lowering their benchmarks, like Jay Powell’s “unexpected” cuts last year, at other times it means yet another QE.

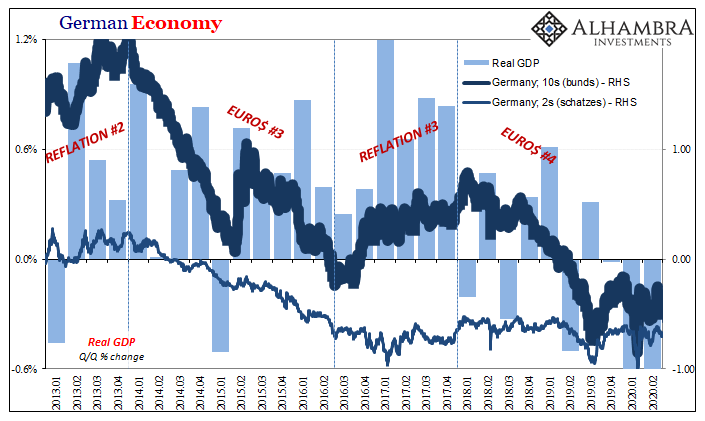

Continuously low rates are, interest rate fallacy, the product of QE’s many failures rather than QE’s bond buying itself. Using the two primary examples of negative yields, Japan and Germany, it’s pretty clear what it is that steers the bond market. It’s a word that starts with “euro” and ends with “dollar.” |

German Economy, 2013-2020 |

| In 2015-16, for example, during Euro$ #3 there wasn’t recession in either Japan or Germany. There were rising risks for one in both places, sure, but the resulting global downturn which did produce recessions in other locations is ultimately what pushed rates all the way to zero with each long end for a time dropping into the minuses.

But, and this is the important part, it was the lack of altitude, the direct product of these persistent monetary problems as described by lackluster reflation (as distinct from real recovery), which is why when the world moved into Euro$ #4 zero nominals were so easily reachable for so many parts of each curve. |

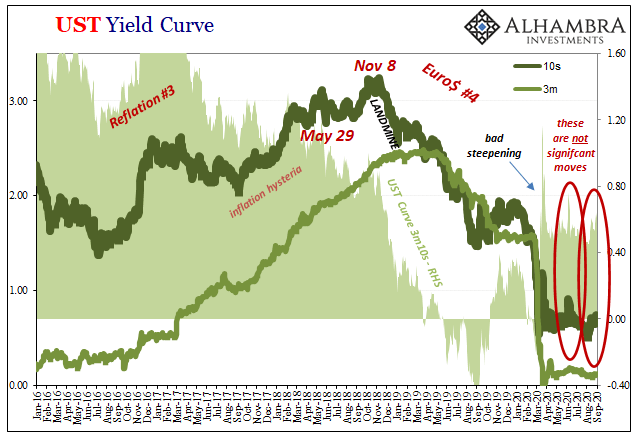

UST Yield Curve, 2003-2020 |

In other words, not recession precisely but lack of recovery in between downturns of whatever ultimate size. That’s why yields turned negative in these key sovereign markets when they did (and why they were nearly simultaneous in doing so). Rising liquidity risks combined with little to no prospects for meaningful economic growth to offset them (recession or not) resulted in this situation people struggle to understand.

Even Economists have figured this out – sort of. They get the result without being able to figure out the cause. When they talk or write about low perhaps negative R* what they are saying is just what I said. The only difference is in assigning the blame for it; the R* people believe the problem is you and me rather than incompetent policymakers. |

|

| Funny how it is those incompetent policymakers who have come up with this R* theory conveniently shifting the blame elsewhere – especially since any real evidence, including bond market behavior, literally, in this case, falls so perfectly and uncomfortably against them.

Getting back to the US Treasury market, then, we don’t necessarily need re-recession in 2020 or early 2021 for the “impossible” to happen in it. After thirteen years of one “impossible” event after another, all it would take would be, essentially, for nothing to meaningfully change. Just more of the same; the interest rate fallacy. Continued liquidity risk plus lack of recovery/growth. And that seems to be the way the final few months of this year might be shaping up. Another recession not required because, when you look at the whole, we never really left the first one. |

UST Yield Curve, 2016-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: bond market,Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,german bunds,interest rate fallacy,Interest rates,Japan,JGB,Markets,negative interest rates,newsletter,QE,recession,U.S. Treasuries,Yield Curve