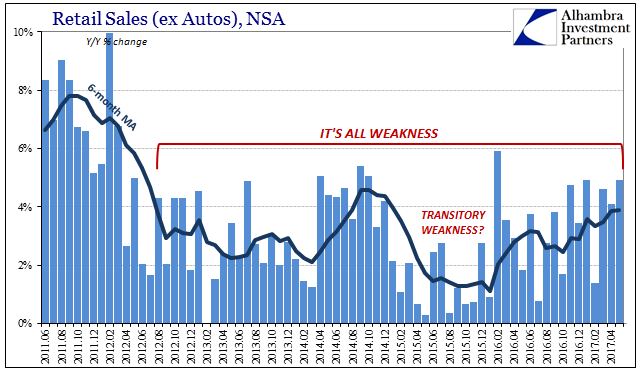

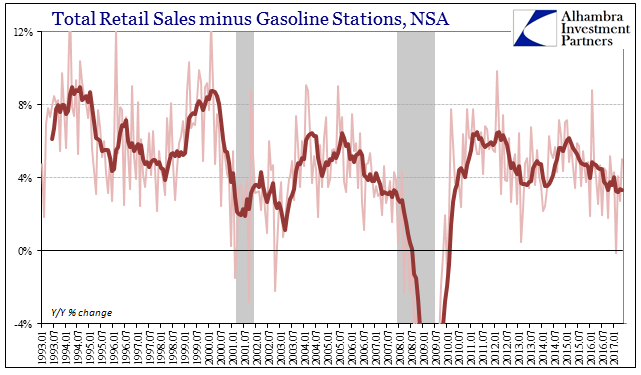

| Taken in comparison to the last few years, today’s retail sales report wasn’t that bad. Total sales for May 2017, including autos, grew by 5.17% year-over-year (NSA). That was the highest growth rate since last February. The 6-month average is now just shy of 4%, the best since early 2015. It is clear the US economy has shrugged off the effects of last year’s downturn.

|

Retail Sales All Weak, June 2011 - June 2017(see more posts on U.S. Retail Sales, ) |

| What got most people’s attention was the negative monthly comparison in the seasonally-adjusted data. Even here, however, the reaction seems a little hyper-sensitive. Though down 0.3% month-over-month, retail sales in April were up by 0.4%. It’s not so much the downside as it is being far too uneven in the advance.

|

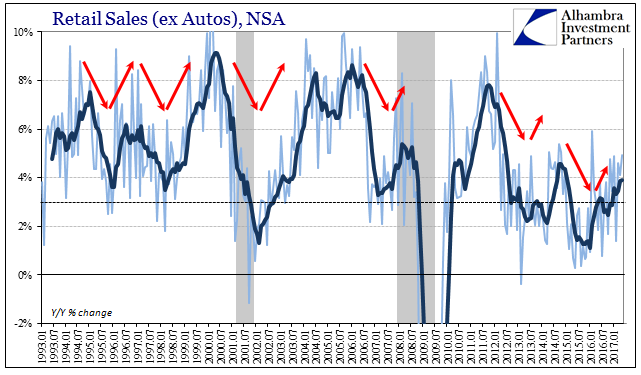

Retail Sales Ex Autos, January 1993 - June 2017 |

| If we are identifying a trough using retail sales, the bottom was clearly January 2016. It only makes sense given all that was going on at that moment in time. But that means, in June 2017 analyzing the economy with statistics from May, that nearly a year and a half has already passed since that point. There is clearly improvement and positive action; it just isn’t working out the way it is supposed to. |

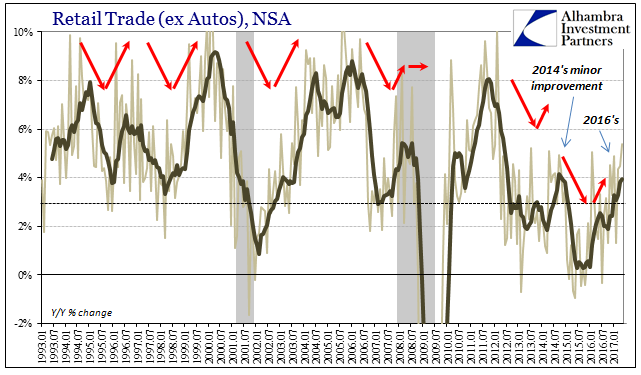

Retail Sales Trade, January 1993 - June 2017 |

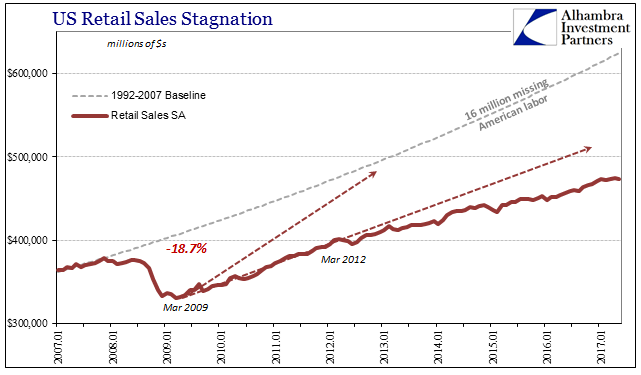

| Growth rates of 5% are fine when compared to what was for too long a constant 3%. In truth, however, that 5% needs to be judged by the downturn that brought those many 3% months as well as the historical context where 6% growth was something of a minimum to be counted as normal (actual growth). What is clearly missing is that momentum, where after fifteen months on the upswing is more than enough time for it to have arrived by now. We still haven’t pushed back above the floor, to say nothing of making up for two years of lost growth. |

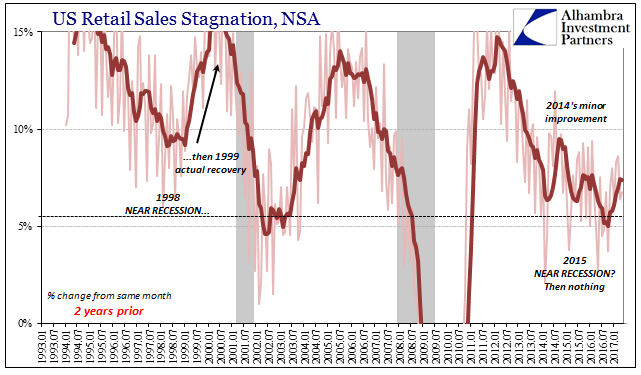

Retail Sales Stagnation, January 1993 - June 2017 |

| The harsh reaction to the seasonally-adjusted negative makes sense. It posits this far along that growth is just not there. The US consumer for all his and her improvement is not anywhere close to normal. By every reasonable expectation, retail sales should be growing by closer to 10% right now than stuck around 4% (average). It is disconcerting to find growth reminiscent of 2014 rather than 2004. |

Total Retail Sales Minus Gasoline Stations, January 1993 - June 2017 |

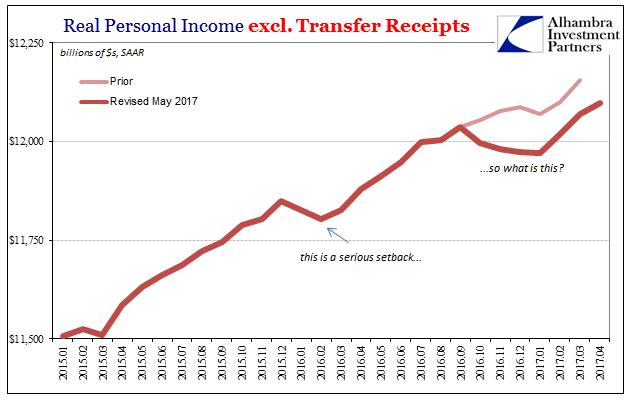

| The issue is as always incomes. Take away the drastic negatives of the “rising dollar” downturn, however you choose to characterize it, and that’s not enough for actual growth. It would have been before 2007, but these are very different conditions. The economic baseline is so distorted and far from normal that to achieve sustainable advance means a whole shift in the underlying fundamentals, starting with incomes. |

Real Personal Income Excluding Transfer Receipts, January 2015 - June 2017 |

| That was what the 4.3% unemployment rate was supposed to mean. In all past periods of “full employment”, a low rate suggested plentiful work as well as rising wages; the beautiful combination that delivers a truly happy consumer spending that good fortune in US as well as global goods and services. Today, we have happy consumers in name only (HCINO?); they claim a high degree of confidence on surveys, but act contrary to that recommendation. If demand consists of both willingness as well as ability, consumer confidence suggests a willingness leaving us to question ability. |

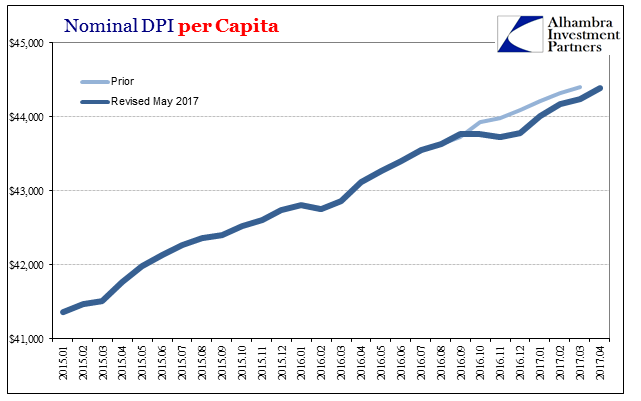

Nominal DPI Per Capita, January 2015 - June 2017 |

| What is it, then, that is holding back wages? It may be a shock to economists, but it has always been the simple fact of the Great “Recession” which just wasn’t a recession. The lack of restoration in labor utilization, the participation problem, can’t just be ignored. It matters as a systemic condition and not just as the misfortune of those who were laid off almost a decade ago and haven’t yet been hired back. It is the vicious cycle that the QE’s were meant to break (through inflation expectations no less; companies were supposed to believe that inflation was just ahead because of all the “money printing” and would respond by greatly increasing current activity in anticipation). |

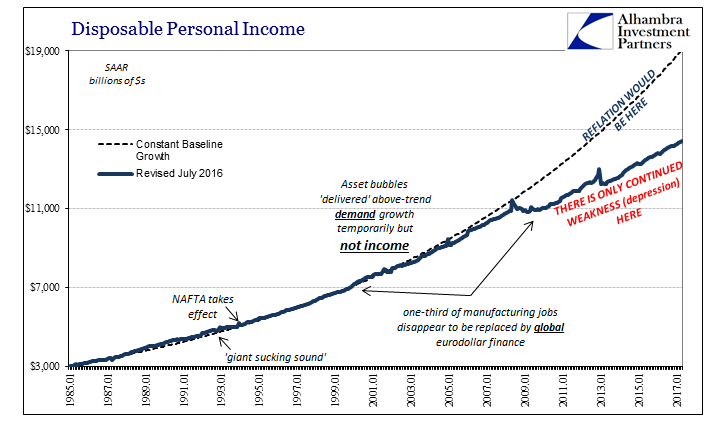

Disposable Personal Income, January 1985 - June 2017 |

| That may be why today’s double whammy of the CPI and retail sales hit so hard in the bond market – landing squarely in Janet Yellen’s face. On a day when the FOMC voted to “raise rates”, the traditional rationale for doing so was so undermined in perhaps the two capacities that matter most right now. |

U.S. Retail Sales Stagnation, January 2007 - June 2017(see more posts on U.S. Retail Sales, ) |

|

The unemployment rate has been deployed time and again since 2014 as if it was stimulus all its own, a convincing enough citation whereby consumers would spring to life and satisfy businesses all over the world to join them by sheer might of a single number. It’s just not plausible anymore, a fact increasingly established as more time passes. It is, in fact, rendered implausible by its extreme levels; if the unemployment rate was a true 4.3% we wouldn’t need to search for signs of growth only to find uneven “improvement.” It’s a jarring juxtaposition after so much time without an inarguable upswing. I wrote in January last year, “If all the optimists have left to stand upon is the unemployment rate, we are in much worse shape than even I thought.” As I’ve stated consistently, the worst case was never recession, it was instead being stuck for a further prolonged period without actual growth. It’s near the middle of 2017, and here we are. Still. |

Accounting For All Labor |

Full story here Are you the author? Previous post See more for Next post

Tags: consumer spending,currencies,economy,employment,Federal Reserve/Monetary Policy,incomes,inflation,Markets,newslettersent,Retail sales,U.S. Retail Sales,wages